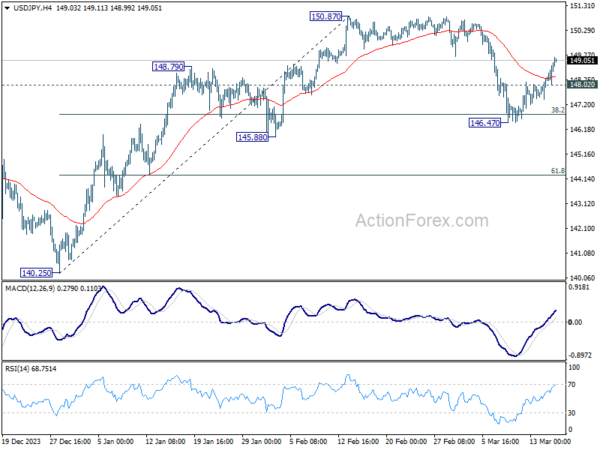

USD/JPY’s strong rebound last week suggests that corrective fall from 150.87 has completed at 146.47, after drawing support from 38.2% retracement of 140.25 to 150.87 at 146.81. Initial bias remains on the upside this week for retesting 150.87/89 key resistance zone. Nevertheless, on the downside, below 148.02 minor support will turn intraday bias neutral first.

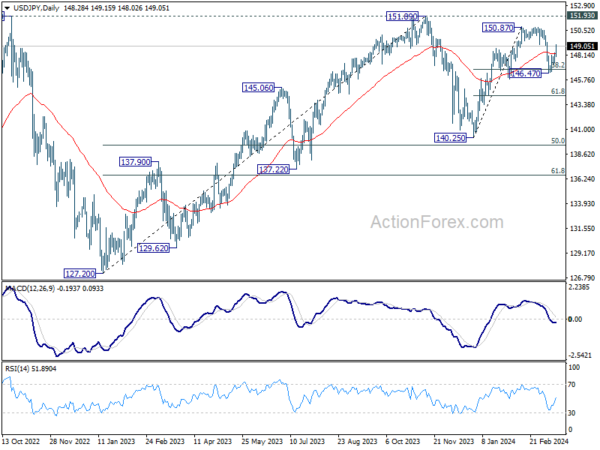

In the bigger picture, no change in the view that price action from 151.89 (2023 high) are correction to up trend from 127.20 (2023 low). The question is whether this correction has completed at 140.25, or extending with fall from 150.87 as the third leg. Sustained break of above mentioned 146.81 fibonacci level will favor the latter case. But even so, downside should be contained by 50% retracement of 127.20 to 151.89 at 139.54

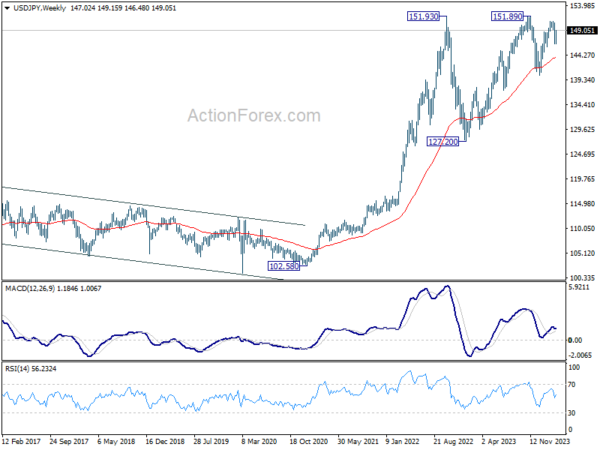

In the long term picture, as long as 125.85 resistance turned support holds (2015 high), up trend from 75.56 (2011 low) is still in favor to continue through 151.93 (2022 high) at a later stage.