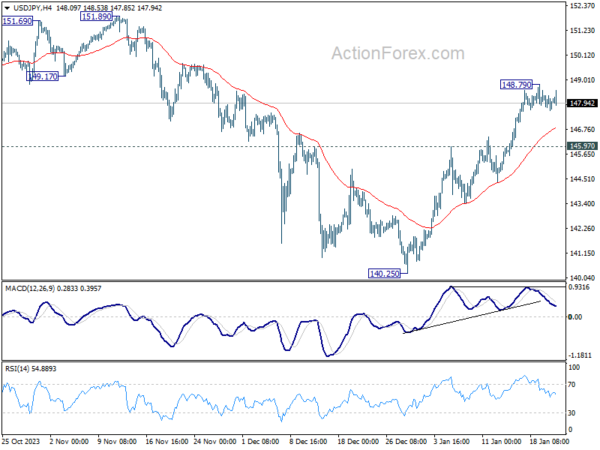

Daily Pivots: (S1) 147.71; (P) 148.03; (R1) 148.44; More…

Intraday bias in USD/JPY remains neutral for the moment. Consolidation from 148.79 temporary top could extend further, and deeper retreat cannot be ruled out. But further rally is expected as long as 145.97 resistance turned support holds. Corrective fall from 151.89 should have completed at 140.25 already. Break of 148.79 will resume the rise from there for retesting 151.89/93 key resistance zone.

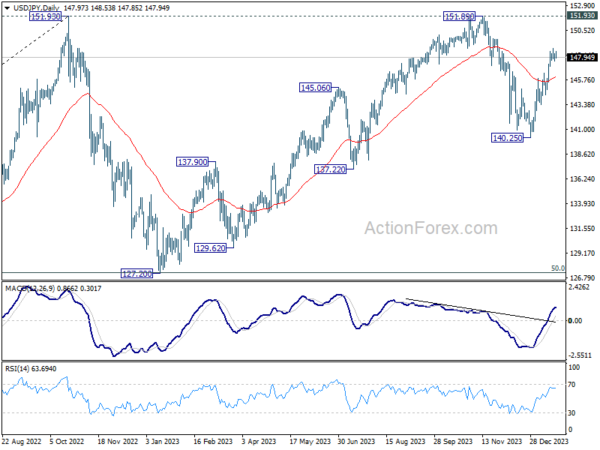

In the bigger picture, stronger than expected rebound from 140.25 dampened the original bearish review. Strong support from 55 W EMA (now at 141.89) is also a medium term bullish sign. Fall from 151.89 could be a correction to rise from 127.20 only. Decisive break of 151.89/93 will confirm resumption of long term up trend. This will now be the favored case as long as 140.25 support holds.