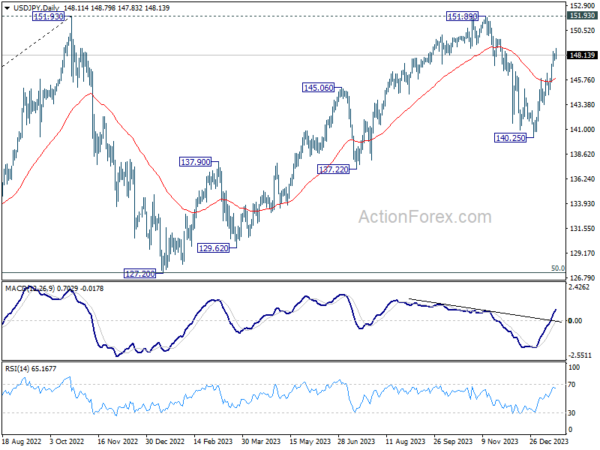

USD/JPY’s rise from 140.25 extended to as high as 148.79 last week, then retreated mildly. Initial bias remains neutral this week for some consolidations first. Current development argues that whole pull back from 151.89 has already completed. Further rise is in favor as long as 145.97 resistance turned support holds. Above 148.79 will target 151.89/93 key resistance zone.

In the bigger picture, stronger than expected rebound from 140.25 dampened the original bearish review. Strong support from 55 W EMA (now at 141.89) is also a medium term bullish sign. Fall from 151.89 could be a correction to rise from 127.20 only. Decisive break of 151.89/93 will confirm resumption of long term up trend. This will now be the favored case as long as 140.25 support holds.

In the long term picture, as long as 125.85 resistance turned support holds (2015 high), up trend from 75.56 (2011 low) is still in favor to continue through 151.93 (2022 high) at a later stage.