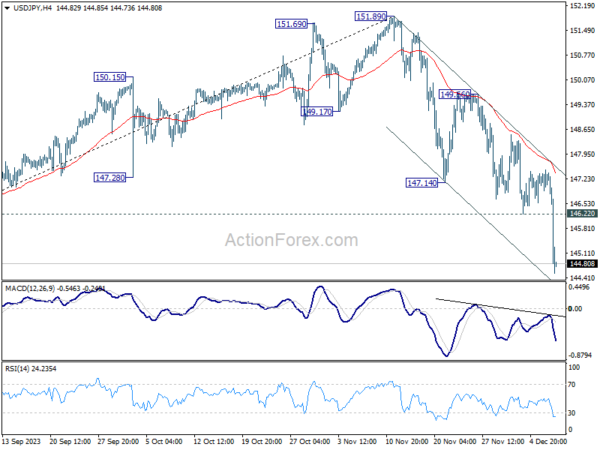

Daily Pivots: (S1) 146.97; (P) 147.23; (R1) 147.57; More…

USD/JPY’s decline accelerates to as low as 144.53 so far and there is no sign of bottoming yet. Intraday bias remains on the downside. Sustained trading below 145.06 will carry larger bearish implication and target 142.45 fibonacci level next. On the upside, break of 146.22 minor resistance will turn intraday bias neutral and bring consolidations first.

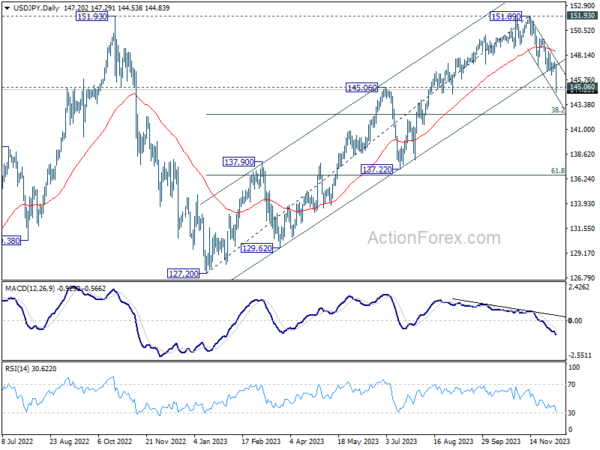

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.