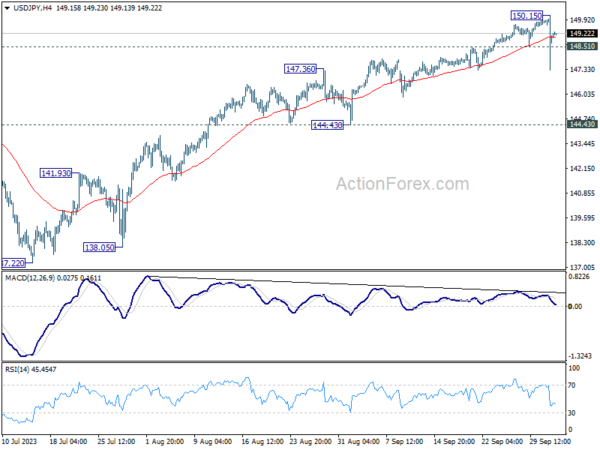

Daily Pivots: (S1) 148.21; (P) 149.18; (R1) 150.03; More…

USD/JPY spiked lower to 147.28 overnight, on alleged intervention by Japan, but recovered quickly since then. As short term top should be in place at 150.15, on bearish divergence condition in 4H MACD. Intraday bias is turned neutral first and more corrective could be seen. But there is no confirmation of bearish trend reversal before firm break of 144.43 support. Another rally remains mildly in favor through 150.15 to retest 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.