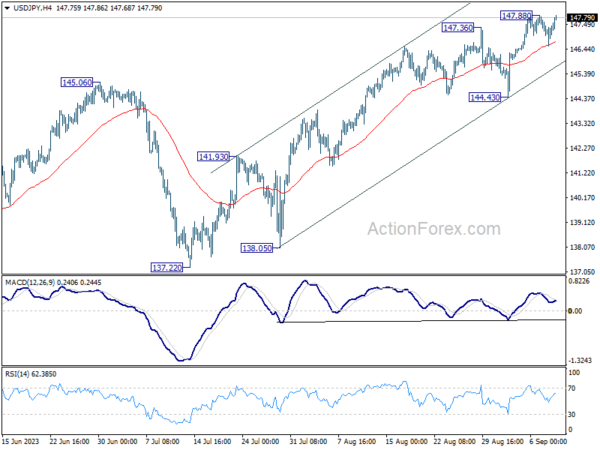

USD/JPY’s near term rally resumed last week but retreated after edging higher to 147.88. Initial bias remains neutral this week for some more consolidations. Outlook will stay bullish as long as 144.43 support holds. On the upside, above 147.88 will resume larger rise from 127.20, to retest 151.93 high.

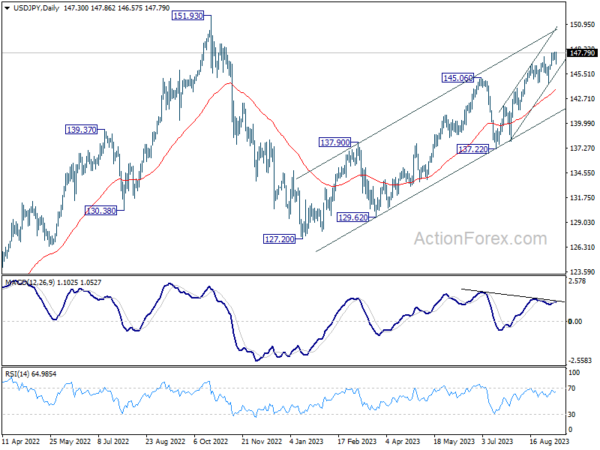

In the bigger picture, while rise from 127.20 is strong could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by break of 137.22 support will indicate that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

In the long term picture, price action from 151.93 is seen as developing into a corrective pattern to up trend from 75.56 (2011 low). Another falling leg could be seen, but in that case, downside should be contained by 38.2% retracement of 75.56 to 151.93 at 122.75. On resumption, next target would be 61.8% projection of 102.58 to 151.93 from 127.20 at 157.69.