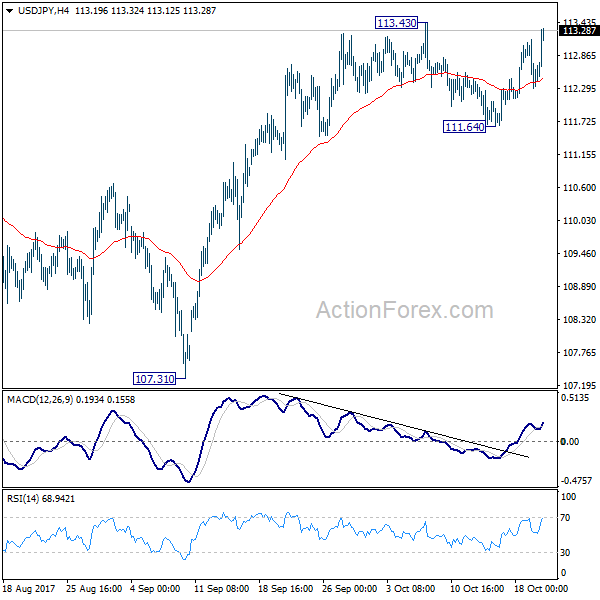

Daily Pivots: (S1) 112.17; (P) 112.66; (R1) 113.02; More…

At this point, USD/JPY is still limited below 113.43 resistance and intraday bias stays neutral first. On the upside, break of 113.43 will resume the rise from 107.31 and target 114.49 resistance. More importantly current development revives the case that correction from 118.65 has completed at 107.31. Decisive break of 114.49 will pave the way to retest 118.65 high. However, break of 111.64 will mixed up the outlook again and turn bias back to the downside for deeper fall.

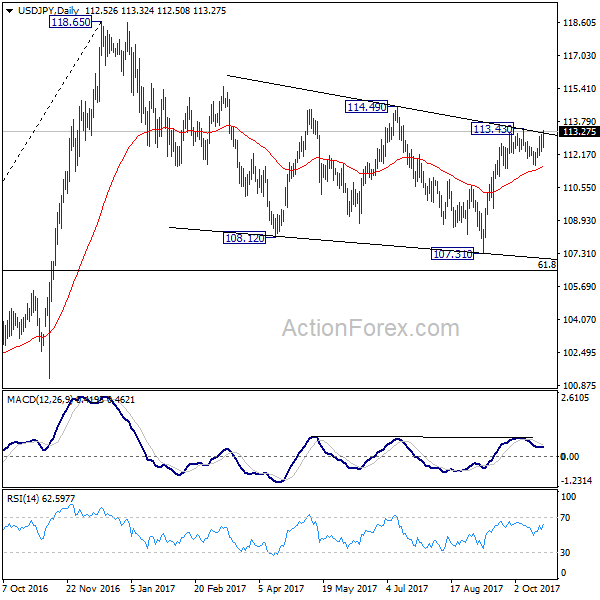

In the bigger picture, rise from 98.97 (2016 low) is seen as the second leg of the corrective pattern from 125.85 (2015 high). It’s unclear whether this second leg has completed at 118.65 or not. But medium term outlook will be mildly bearish as long as 114.49 resistance holds. And, there is prospect of breaking 98.97 ahead. Meanwhile, break of 114.49 will bring retest of 125.85 high. But even in that case, we don’t expect a break there on first attempt.