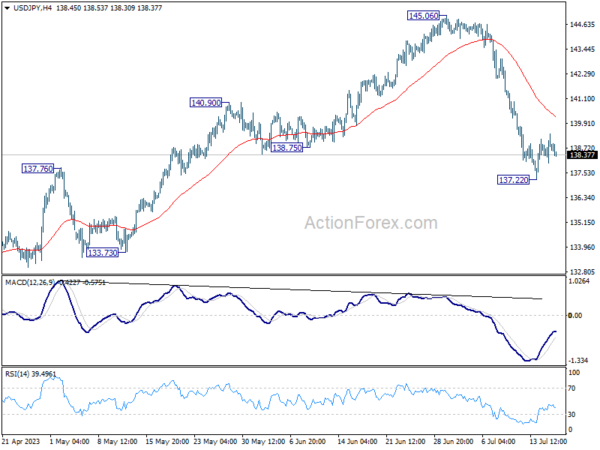

Daily Pivots: (S1) 138.01; (P) 138.71; (R1) 139.41; More…

Intraday bias in USD/JPY remains neutral as consolidation from 137.22 is extending. Upside of recovery should be limited by 55 4H EMA (now at 140.18) and bring another decline. Break of 137.22 and sustained trading below 137.90 resistance turned support will confirm the larger bearish case, and target 127.20 and below.

In the bigger picture, fall from 145.06 is seen as the third leg of the corrective pattern from 151.93 (2022 high). Sustained break of 137.90 resistance turned support should confirm this case and target 127.20 (2023 low) and below. For now, this will remain the favored case as long as 145.06 resistance holds, even in case of strong rebound.