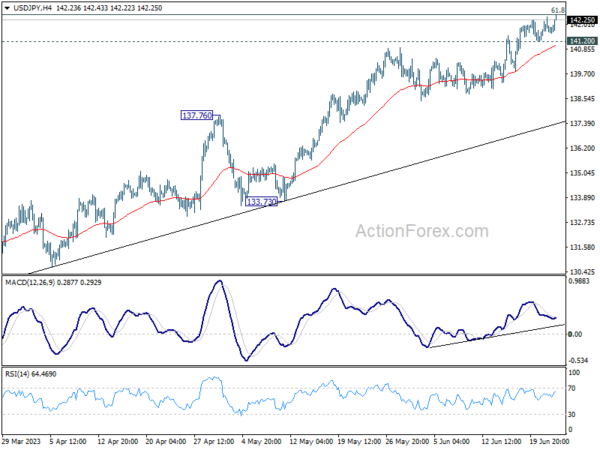

Daily Pivots: (S1) 141.34; (P) 141.85; (R1) 142.41; More…

No change in USD/JPY’s outlook as further rally is expected with 141.20 minor support intact. Sustained trading above 61.8% retracement of 151.93 to 127.20 at 142.48 would extend the rise from 127.20 towards 151.93 high. However, break of 141.20 minor support will be the first sign of rejection by 142.48, and turn bias back to the downside for 55 D EMA (now at 137.77).

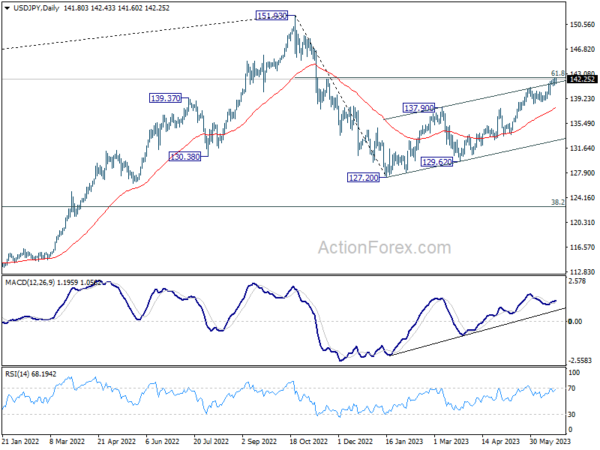

In the bigger picture, rise from 151.93 are seen as a corrective pattern to up trend from 102.58. The first leg has completed at 127.20. Rebound from there is seen as the second leg, and should be limited below 151.93. Sustained trading below 55 D EMA (now at 137.47) will argue that the third leg has started back to 127.20 and possibly below.