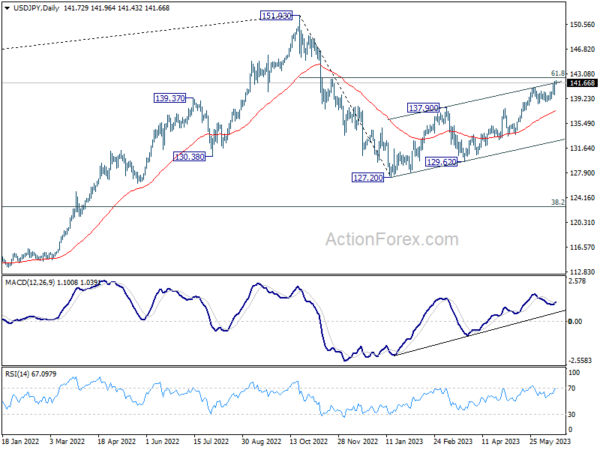

Daily Pivots: (S1) 140.47; (P) 141.19; (R1) 142.54; More…

Intraday bias in USD/JPY remains on the upside at this point, for 61.8% retracement of 151.93 to 127.20 at 142.48 next. Sustained break there will pave the way back to retest 151.93 high. However, rejection by 142.48, followed by break of 139.27 will indicate short term topping and turn bias back to the downside.

In the bigger picture, rise from 151.93 are seen as a corrective pattern to up trend from 102.58. The first leg has completed at 127.20. Rebound from there is seen as the second leg, and should be limited below 151.93. Sustained trading below 55 D EMA (now at 137.47) will argue that the third leg has started back to 127.20 and possibly below.