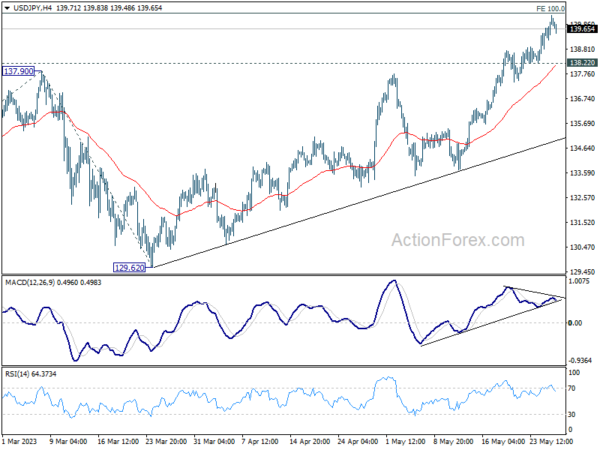

Daily Pivots: (S1) 139.18; (P) 139.70; (R1) 140.57; More…

Intraday bias in USD/JPY is turned neutral first with current retreat. On the downside, break of 138.22 support indicate short term topping, after failing 100% projection of 127.20 to 137.90 from 129.62 at 140.32. Intraday bias will turn back to the downside for 55 D EMA (now at 135.39). ON the upside, through, break of 140.32 will extend the rise from 127.20 to 142.48 fibonacci level.

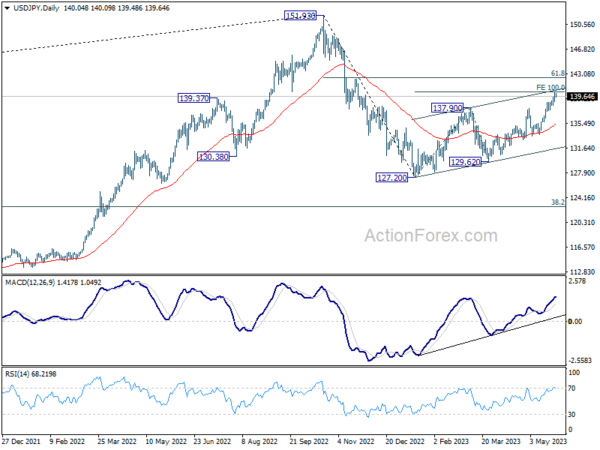

In the bigger picture, rise from 127.20 is seen as the second leg of the corrective pattern from 151.93 high. Stronger rally would be seen to 61.8% retracement of 151.93 to 127.20 at 136.34. Sustained break there will pave the way back to retest 151.93. On the downside, however, break of 133.73 support will argue that the pattern could have started the third leg through 127.20 low.