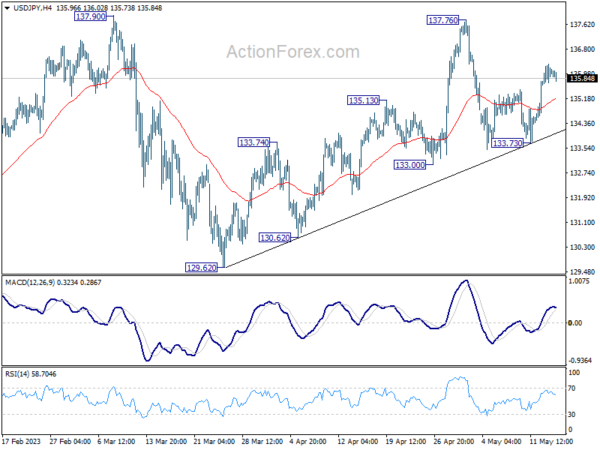

Daily Pivots: (S1) 135.73; (P) 136.02; (R1) 136.40; More…

Intraday bias in USD/JPY stays mildly on the upside at this point. Rally from 133.73 should be on track to retest 137.76/90 resistance zone. Decisive break there will resume whole rebound from 127.20. On the downside, break of 133.73 will resume the fall from 137.76 through 133.00 instead.

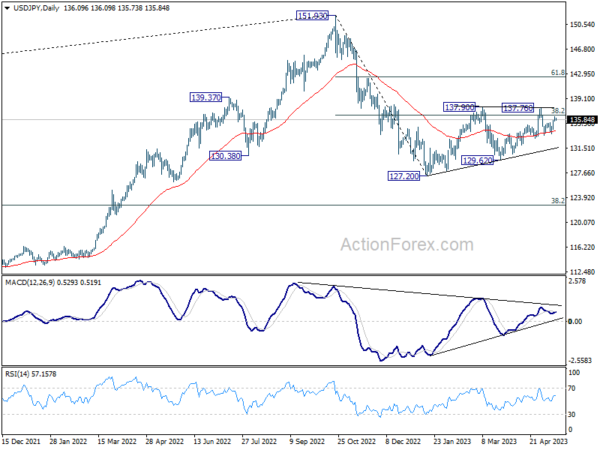

In the bigger picture, price actions from 151.93 high are currently seen as a corrective pattern to the long term up trend. The first leg should have completed at 127.20. Rebound from there is seen as the second leg. Sustained break of 38.2% retracement of 151.93 to 127.20 at 136.34 will bring stronger rise to 61.8% retracement at 142.48. Meanwhile, break of 129.62 will argue that the third leg is starting through 127.20 low.