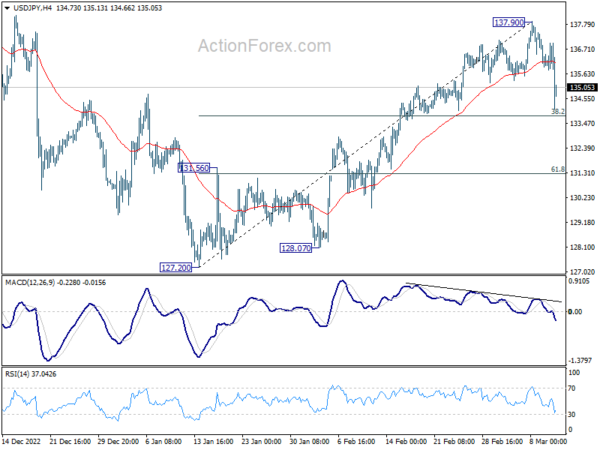

USD/JPY’s decline last week confirms short term topping at 137.90, on bearish divergence condition in 4 hour MACD. Initial bias stays on the downside this week for 38.2% retracement of 127.20 to 137.90 at 133.81. Some support could be seen there to bring rebound. But near term risk will stay on the downside as long as 137.90 resistance holds, in case of recovery. Sustained break of 133.81 will carry larger bearish implication and target 61.8% retracement at 131.28.

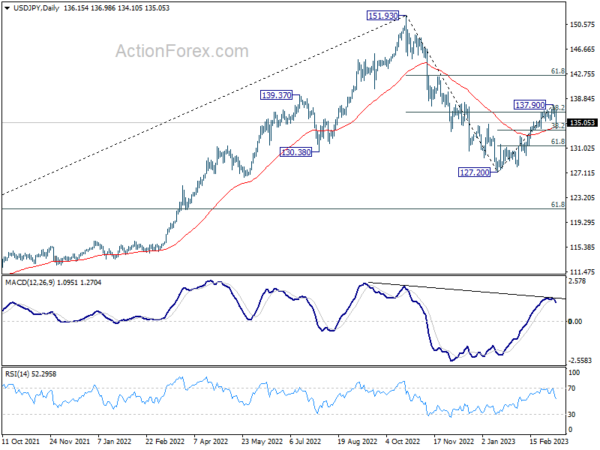

In the bigger picture, down trend from 151.93 (2022 high) is tentatively seen as completed at 127.20 already. Break of 137.90 will resume the rise to 61.8% retracement of 151.93 to 127.20 at 142.48. However, sustained trading below 55 day EMA (now at 134.31) will dampen this bullish view, argue that fall from 151.93 is still on track to another low below 127.20.

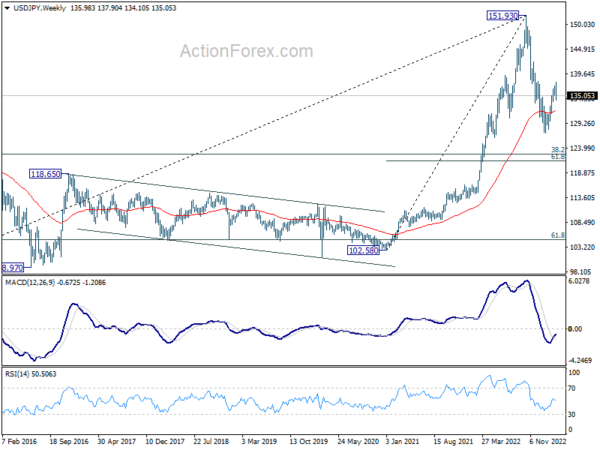

In the long term picture, price action from 151.93 is seen as developing into a corrective pattern to up trend from 75.56 (2011 low). While deeper decline cannot be ruled out, downside should be contained by 38.2% retracement of 75.56 to 151.93 at 122.75.