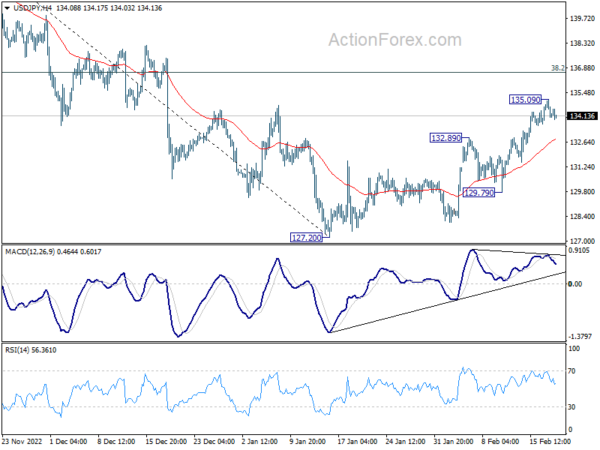

Daily Pivots: (S1) 133.69; (P) 134.40; (R1) 134.85; More…

Intraday bias in USD/JPY remains neutral for the moment. On the upside, break of 135.09 will resume the rise from 127.20 to 38.2% retracement of 151.93 to 127.20 at 136.64. Strong resistance could be seen there to complete the corrective rebound. On the downside, break of 132.89 will bring deeper fall to 129.79 support.

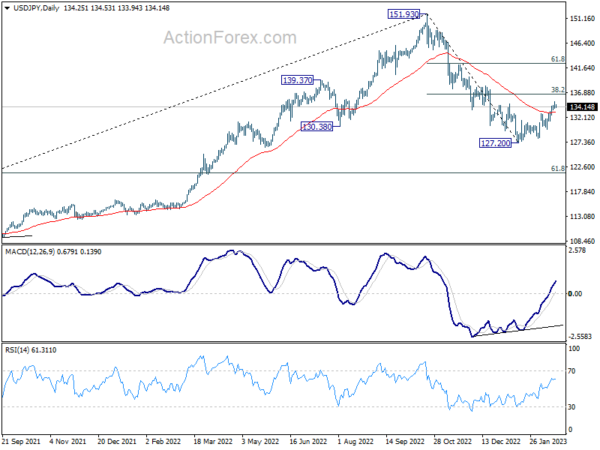

In the bigger picture, prior break of 55 week EMA (now at 131.47) raises the chance of medium term bearish reversal, but that’s not confirmed yet. Strong rebound from current level, followed by sustained break of 38.2% retracement of 151.93 to 127.20 at 136.64 will argue that price actions from 151.93 is merely a corrective pattern. However, rejection by 136.64 will solidify medium term bearishness for 61.8% retracement of 102.58 to 151.93 at 121.43 and 38.2% retracement of 75.56 to 151.93 at 122.75.