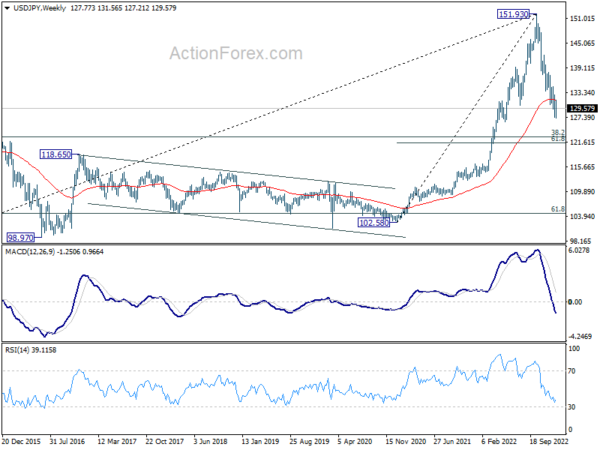

USD/JPY edged lower to 127.20 last week but turned sideway since then. Initial bias stays neutral this week first. There is no clear sign of bottoming yet, and another fall remains mildly in favor. Break of 127.20 will resume the whole decline from 151.93 and target 121.43 fibonacci level. Nevertheless, break of 131.56 should confirm short term bottoming, and turn bias back to the upside for stronger rebound.

In the bigger picture, the break of 55 week EMA (now at 131.52) raises the chance of medium term bearish reversal, but that’s not confirmed yet. Strong support could be seen around 61.8% retracement of 102.58 to 151.93 at 121.43 and 38.2% retracement of 75.56 to 151.93 at 122.75 to bring rebound. But break of 131.56 resistance is needed to indicate bottoming first. Otherwise further fall will remain in favor.

In the long term picture, 151.93 looks increasingly likely a major top. But it’s too early to call for long term bearish reversal at this point. Rebound from around 38.2% retracement of 75.56 to 151.93 at 122.75 will keep the case open for price action from 151.93 to be just a corrective pattern.