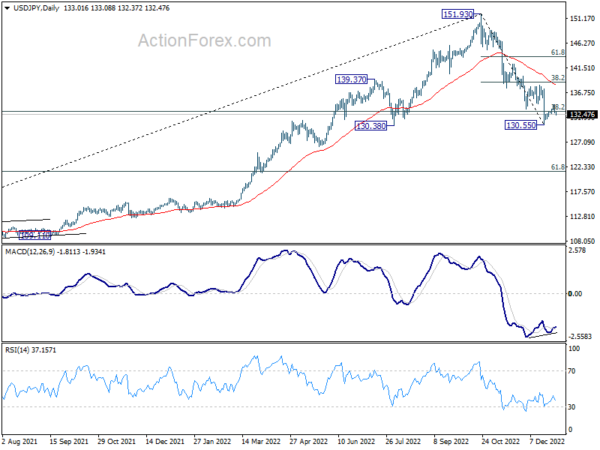

Daily Pivots: (S1) 132.45; (P) 133.45; (R1) 134.03; More…

Break of 132.61 minor support argues that recovery form 130.55 has completed earlier than expected at 134.49. Intraday bias is back on the downside for 130.55 support. On the upside, above 134.49 should resume the rebound through near term channel resistance, towards 38.2% retracement of 151.93 to 130.55 at 138.71.

In the bigger picture, price actions from 151.93 medium term could be just a corrective pattern to up trend from 102.58 (2021 low). Strong support from 38.2% retracement of 102.58 to 151.93 at 133.07 and 55 week EMA (now at 131.76) will set the range for such corrective pattern. However, sustained break of 55 week EMA will pave the way to 61.8% retracement at 121.43.