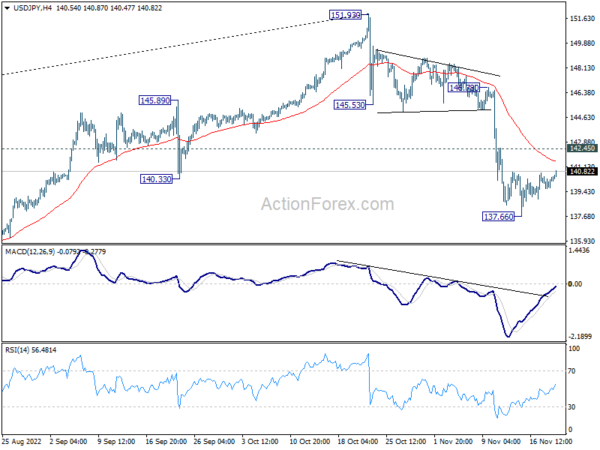

Daily Pivots: (S1) 139.84; (P) 140.17; (R1) 140.70; More…

Intraday bias in USD/JPY remains neutral for the moment as consolidations from 137.66 is extending. Further decline is in favor as long as 142.45 minor resistance holds. On the downside, break of 137.66 will resume the decline from 151.93, to 133.07 fibonacci level, as a correction to the larger up trend. Nevertheless, firm break of 142.45 will turn bias back to the upside for stronger rebound to 55 day EMA (now at 143.44) and above.

In the bigger picture, a medium term top should be formed at 151.93. Fall from there is correcting larger up trend from 102.58. It’s too early to call for bearish trend reversal. But even as a corrective move, such decline should target 38.2% retracement of 102.58 to 151.93 at 133.07, or further to 55 week EMA (now at 130.28).