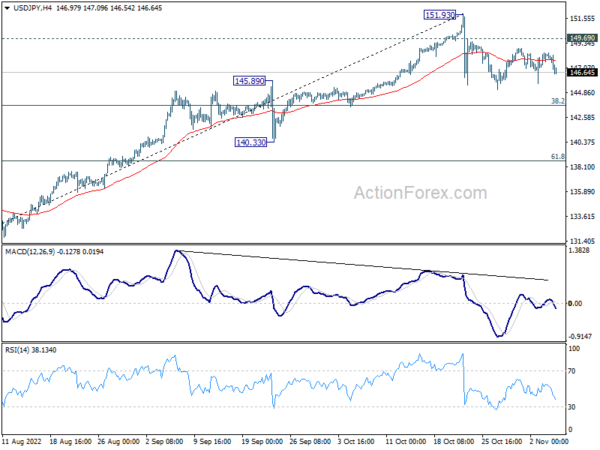

USD/JPY extended the consolidation pattern from 151.93 last week. Outlook is unchanged and initial bias stays neutral this week. Another fall could be seen, but downside should be contained by 38.2% retracement of 130.38 to 151.93 at 143.69 to bring rebound. On the upside, above 149.69 minor resistance will bring stronger rebound back towards 151.93 high. But upside should be limited there to continue the corrective pattern.

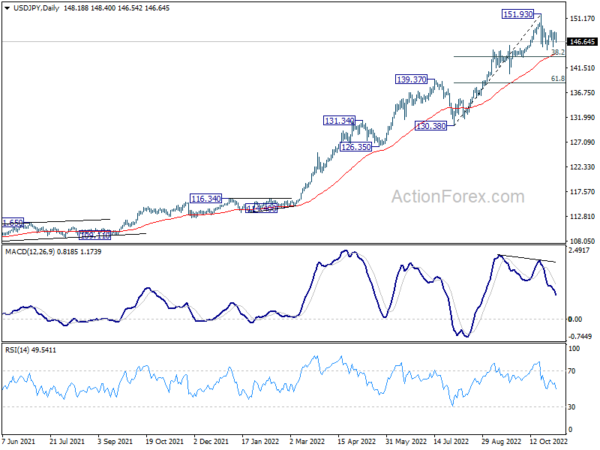

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). 147.68 (1998 high) was already met and there is no clearly sign of topping yet. In any case, break of 140.33 support is needed to be the first sign of medium term topping. Otherwise, further rise is in favor to next target at 160.16 (1990 high).

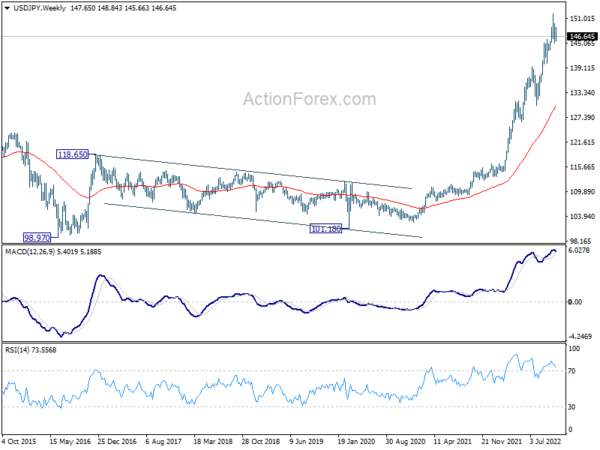

In the long term picture, rise from 101.18 is seen as part of the up trend from 75.56 (2011 low). Sustained break of 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, will pave the way to 138.2% projection at 168.47. This will remain the favored case as long as 139.37 resistance turned support holds.