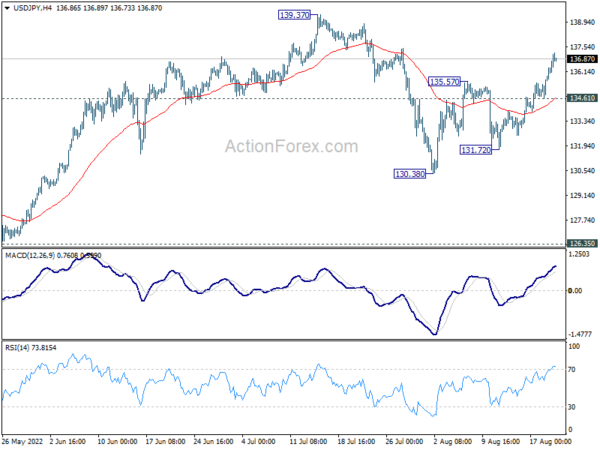

USD/JPY’s rebound from 130.38 resumed by breaking through 135.57 last week. Initial bias stays on the upside this week for retesting 139.37 high. Strong resistance could be seen there to bring another fall to extend the corrective pattern from 139.37. On the downside below 134.61 minor support will turn intraday bias neutral first.

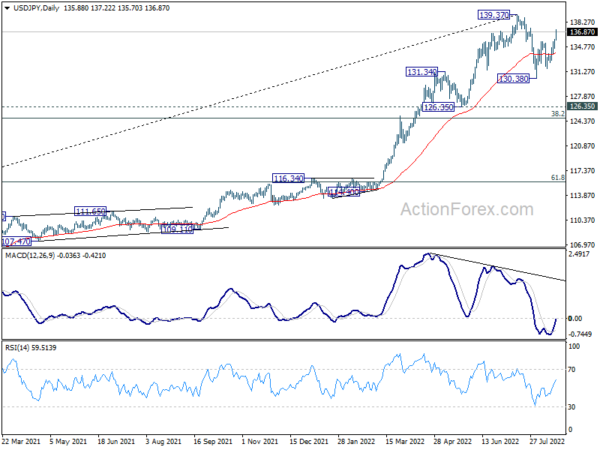

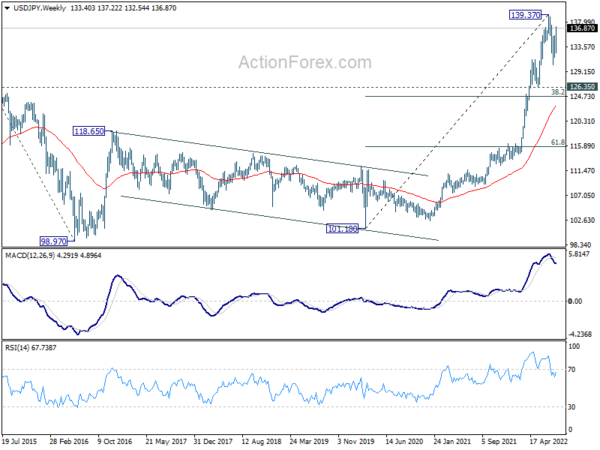

In the bigger picture, price actions from 139.37 medium term top are seen as a corrective pattern to up trend from 101.18 (2020 low). While deeper decline cannot be ruled out, outlook will stays bullish as long as 55 week EMA (now at 123.21) holds. Long term up trend is expected to resume through 139.37 at a later stage, after the correction finishes.

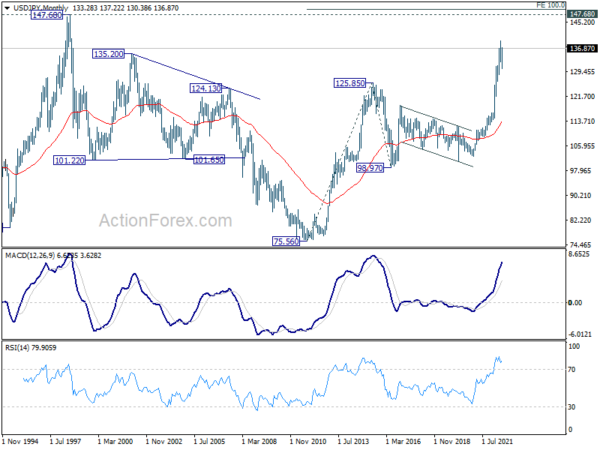

In the long term picture, rise from 101.18 is seen as part of the up trend from 75.56 (2011 low). Further rally is expected to 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 149.26, which is close to 147.68 (1998 high). This will remain the favored case as long as 55 week EMA (now at 123.21) holds.