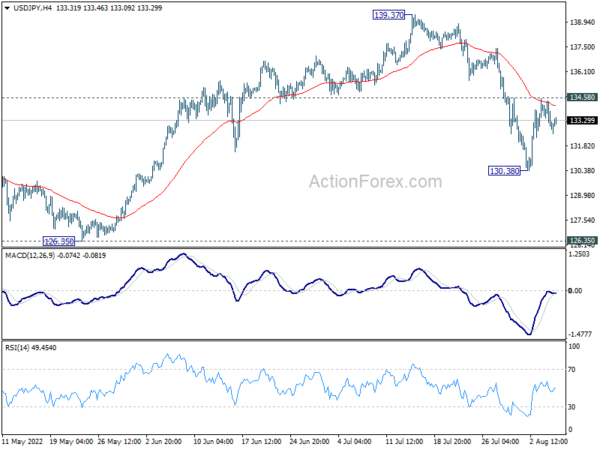

Daily Pivots: (S1) 132.31; (P) 133.37; (R1) 133.97; More…

Intraday bias in USD/JPY stays neutral at this point and outlook is unchanged. Correction from 139.37 could still extend through 130.38. But downside should be contained above 126.35 support, at least on first attempt, to bring rebound. On the upside, firm break of 134.58 will turn bias to the upside for stronger rally to retest 139.37 high.

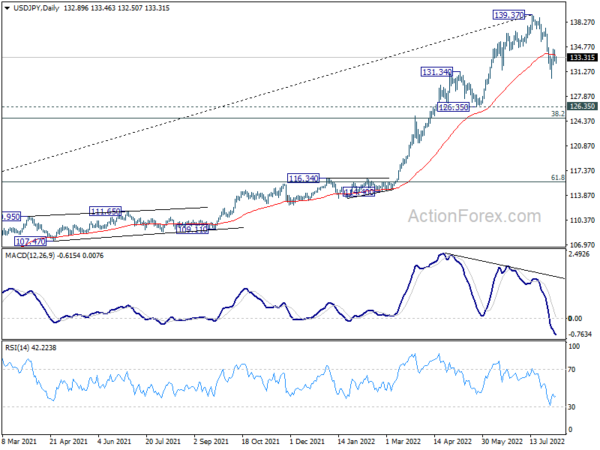

In the bigger picture, a medium term top should be in place at 139.37, on bearish divergence condition in daily MACD. Fall from there could be correcting whole up trend from 101.18 (2020 low). While deeper decline cannot be ruled out, outlook will stays bullish as long as 55 week EMA (now at 121.84) holds. Long term up trend is expected to resume through 139.37 at a later stage, after the correction finishes.