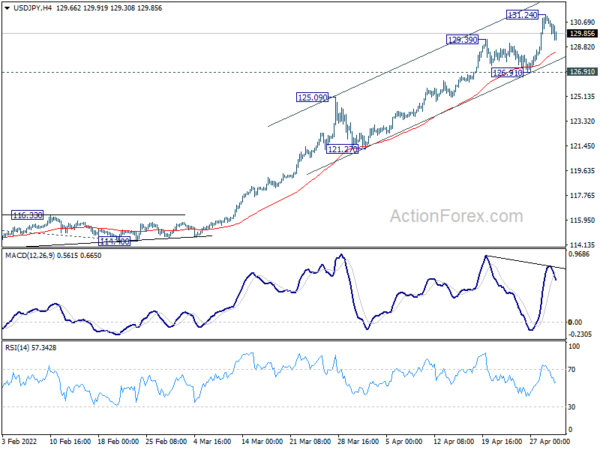

USD/JPY’s up trend continued last week as hit 131.24. As a temporary top was formed, initial bias is neutral this week for consolidation. Outlook will remain bullish as long as 126.91 support holds. Break of 131.24 will resume the up trend to 261.8% projection of 109.11 to 116.34 from 114.40 at 133.26. However, considering bearish divergence condition in 4 hour MACD, break of 126.91 will confirm short term topping and turn bias back to the downside for a correction.

In the bigger picture, current rally is seen as part of the long term up trend form 75.56 (2011 low). Sustained trading above 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04 will pave the way to 100% projection at 149.26, which is close to 147.68 (1998 high). For now, this will remain the favored case as long as 121.27 support holds.

In the long term picture, the up trend from 75.56 (2011 low) long term bottom to 125.85 (2015 high) has just resumed. First target is 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04. Next is 100% projection at 149.26, which is close to 147.68 (1998 high).