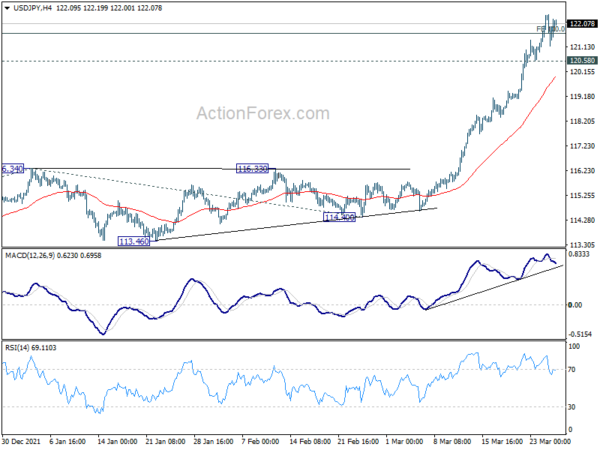

USD/JPY’s up trend accelerated further to as high as 122.43 last week, and met 100% projection of 109.11 to 116.34 from 114.40 at 121.63 already. Further rise is expected as long as 120.58 support holds. Sustained trading above 121.63 will pave the way to 161.8% projection at 126.09, which is close to 125.85 long term resistance. On the downside, break of 120.58 minor support will turn intraday bias neutral and bring consolidation first, before staging another rally.

In the bigger picture, up trend from 98.97 (2016 low) in in progress for retesting 125.85 (2015 high). Sustained break there will confirm long term up trend resumption. Next target will be 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04. This will now remain the favored case as long as 116.34 resistance turned support holds.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective pattern that might have completed at 98.97 already. Firm break of 125.85 will target 61.8% projection of 75.56to 125.85 from 98.97 at 103.04. Next is 100% projection at 149.26, which is close to 147.68 (1998 high).