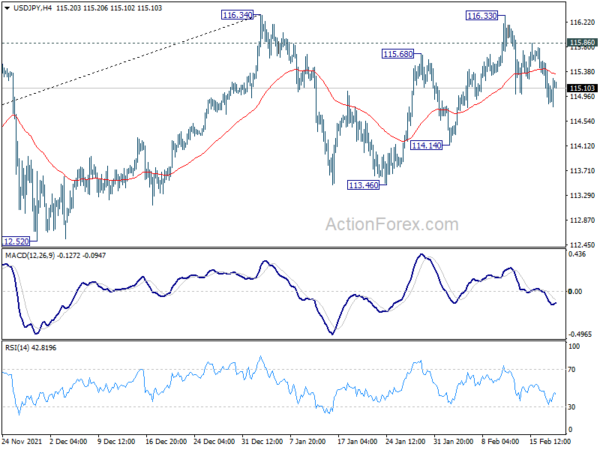

Daily Pivots: (S1) 114.67; (P) 115.11; (R1) 115.36; More…

intraday bias in USD/JPY stays mildly on the downside at this point. Fall from 116.33 is seen as the third leg of the corrective pattern from 116.34. Deeper decline should be seen to 114.14 support, and then 113.46. On the upside, however, break of 115.86 will turn bias back to the upside for 116.34 resistance instead.

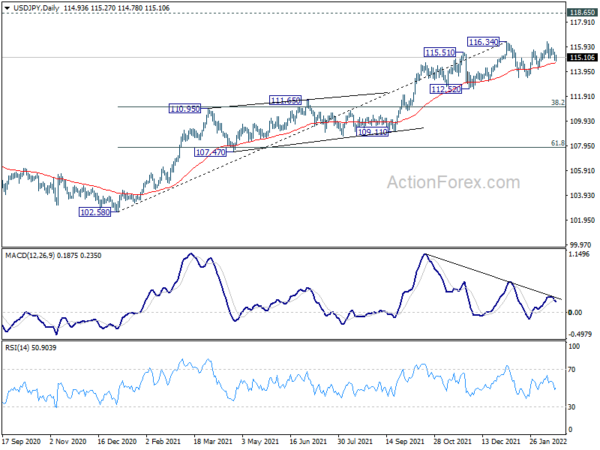

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high). Sustained break there will pave the way to 120.85 (2015 high) and raise the chance of long term up trend resumption. This will remain the favored case as long as 55 week EMA (now at 111.21) holds.