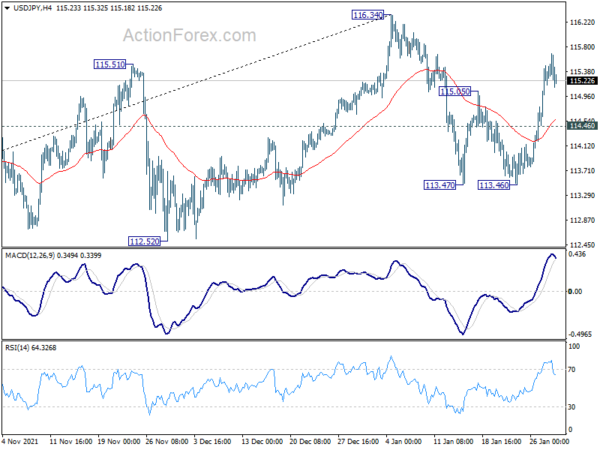

USD/JPY’s break of 115.05 resistance last week suggests that pull back from 116.34 has completed at 113.46 already. Strong support from 55 day also retain near term bullishness. Initial bias stays on the upside this week for 116.34 first. Decisive break there will resume larger up trend for 118.65 long term resistance next. On the downside, below 114.46 minor support will mix up the near term outlook and turn intraday bias neutral again.

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high). Sustained break there will pave the way to 120.85 (2015 high) and raise the chance of long term up trend resumption. This will remain the favored case as long as 55 week EMA (now at 111.07) holds.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective pattern which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.