Daily Pivots: (S1) 114.42; (P) 114.96; (R1) 115.28; More…

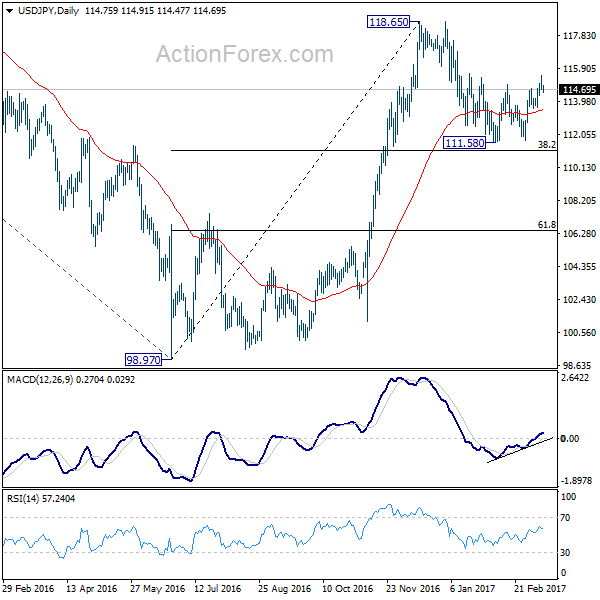

USD/JPY retreats further today but loss is limited so far. Intraday bias stays neutral for consolidation below 115.49 temporary top. Deeper retreat could be seen to 4 hour 55 EMA (now at 114.22). But downside should be contained well above 113.60 support and bring another rally. As noted before, corrective decline from 118.65 should have completed with a a double bottom pattern (111.58, 111.68). Above 115.49 should turn bias to the upside and pave the way for a test on 118.65. Decisive break there will extend whole rise from 98.97 and target 125.85 high next. However, break of 113.60 will invalidate our view and turn bias back to the downside for 111.58/68 support zone instead.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.85 and below will extend the consolidation with another falling leg before up trend resumption.