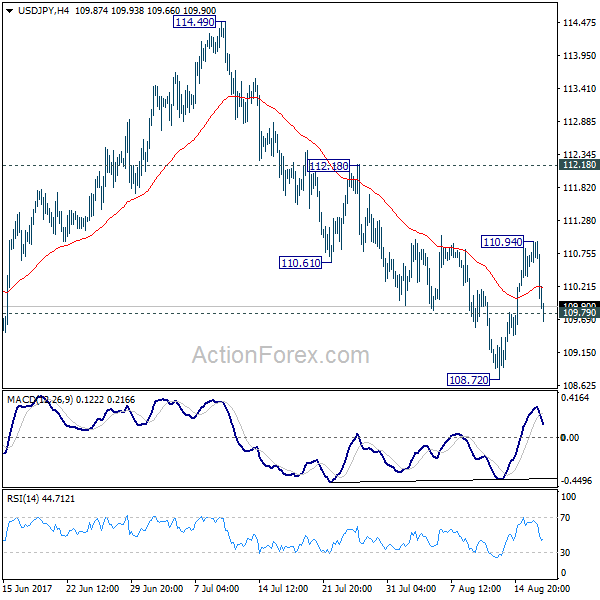

Daily Pivots: (S1) 109.82; (P) 110.38; (R1) 110.74; More…

USD/JPY’s sharp fall and break of 109.79 minor support argues that rebound from 108.72 has completed at 110.94. Intraday bias is turned back to the downside for retesting 108.72 first. Break of 108.72 will likely resume the whole decline from 118.65 through 108.12 to next medium term fibonacci level at 106.48. On the upside, above 110.94 will extend the rebound to 112.18 resistance next.

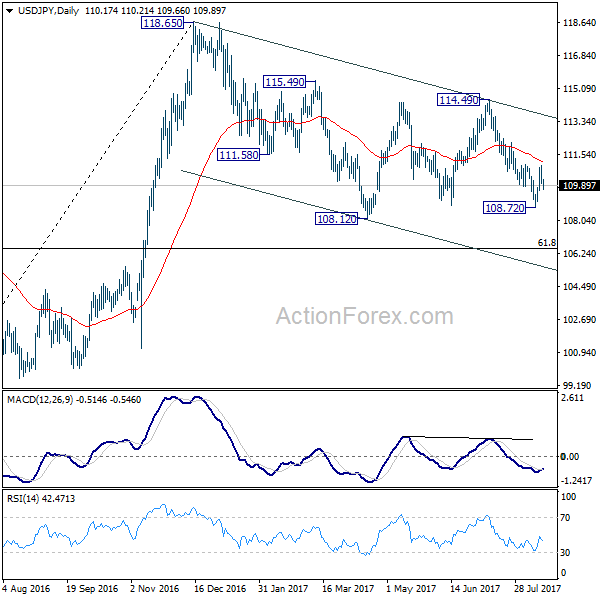

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, downside should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.