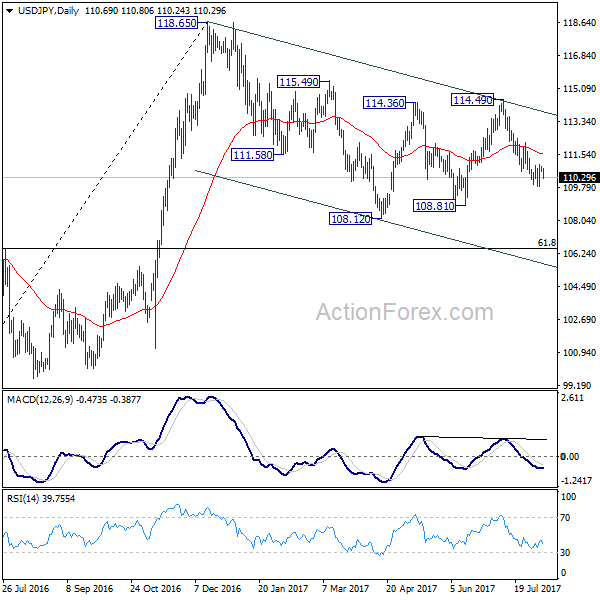

Daily Pivots: (S1) 110.60; (P) 110.76; (R1) 110.88; More…

USD/JPY was rejected by 4 hour 55 EMA and continues to weaken today. But at this point, it’s still staying above 109.83 temporary low. Intraday bias remains neutral for the moment. The consolidation from 109.83 might extend and another rise cannot be ruled out. But after all, near term outlook stays bearish as long as 112.18 resistance holds and deeper fall is expected. Break of 109.83 will target 108.81 support first. Break there will resume whole correction from 118.65 and target 61.8% retracement of 98.97 to 118.65 at 106.48. Nonetheless, break of 112.18 resistance will dampen our bearish view and turn focus back to 114.49 resistance instead.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, down side should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.