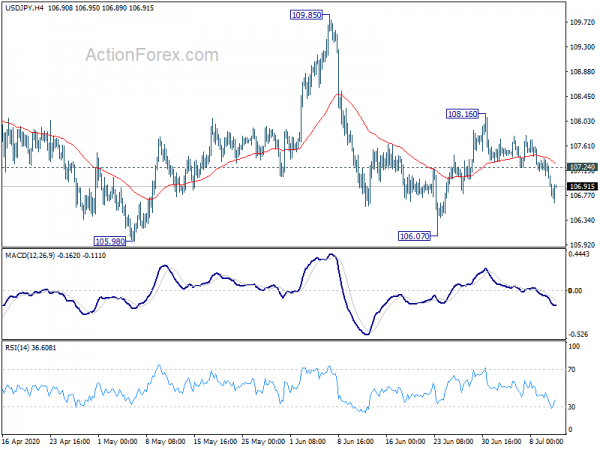

USD/JPY’s sharp decline last week suggests that rebound from 106.07 has completed at 108.16 already. more importantly, he corrective pattern from 111.71 is likely extending with another falling leg. Initial bias remains mildly on the downside this week for 106.07 support first. Break will target 61.8% retracement of 101.18 to 111.71 at 105.20. On the upside, break of 107.24 minor resistance will turn intraday bias neutral first.

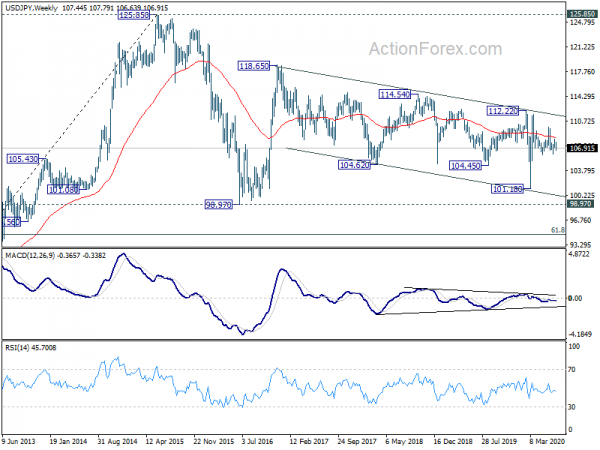

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.