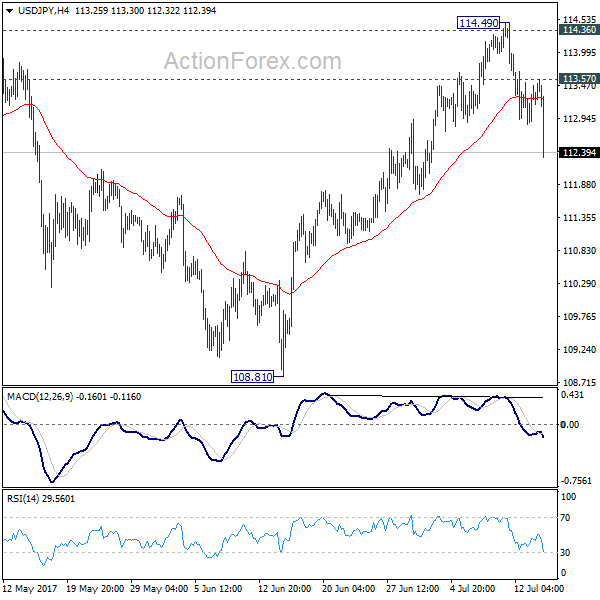

Daily Pivots: (S1) 112.92; (P) 113.22; (R1) 113.58; More…

USD/JPY’s decline resumes in early US session and reaches as low as 112.44 so far. The break of 112.88 support indicates rejection from 114.36 resistance. And, rise from 108.81 should be completed at 114.49. More importantly, the corrective pattern from 118.65 is likely still in progress. Intraday bias is now back on the downside for 55 day EMA (now at 111.98). Firm break there will target 108.12 low and below. Above 113.57 minor resistance will turn focus back to 114.49 resistance instead.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85.