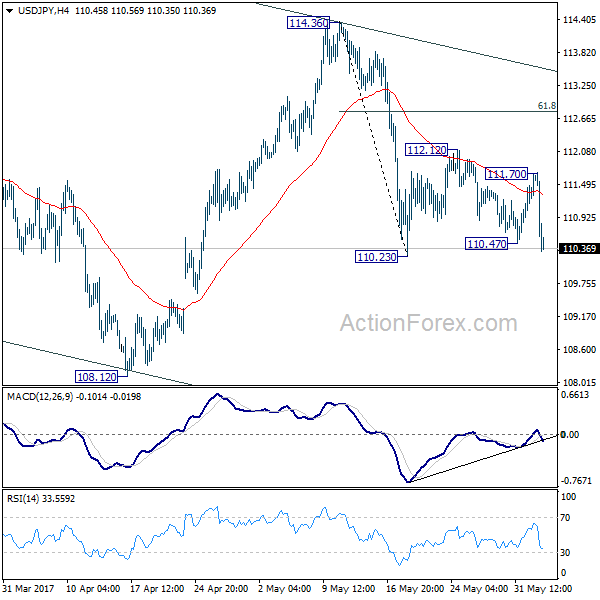

USD/JPY recovered ahead of 110.23 last week as consolidation from there extended. But it was rejected by 55 day EMA and dropped sharply to close at 110.36. Initial bias is cautiously on the downside this week. Break of 110.23 will resume the fall from 114.36. In such case, intraday bias will be turned back to the downside for 108.12 and below. Whole decline from 118.65 is seen as a correction and is still in progress. We’ll look for bottoming signal at 61.8% retracement of 98.97 to 118.65 at 106.48 as the correction extends. Meanwhile, above 111.70 will turn intraday bias back to the upside. But we’d expect strong resistance from 61.8% retracement of 114.36 to 110.23 at 112.78 to limit upside and bring fall resumption.

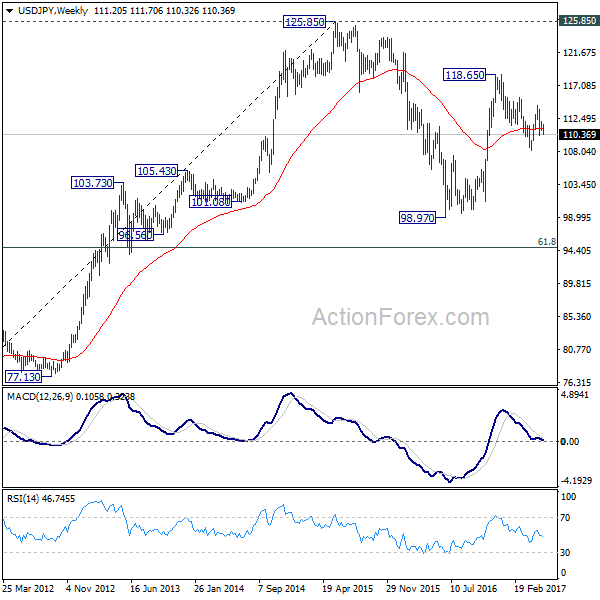

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

In the long term picture, the rise from 75.56 long term bottom to 125.85 medium term top is viewed as an impulsive move. Price actions from 125.85 are seen as a corrective move which could still extend. But, up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.