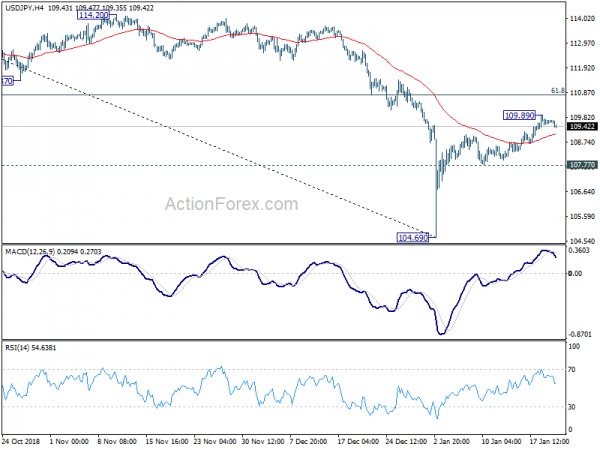

Daily Pivots: (S1) 109.50; (P) 109.63; (R1) 109.80; More…

With 4 hour MACD dropped below signal line, a temporary top is in place at 109.89. Intraday bias in USD/JPY is turn neutral first. Another rise could be seen with 107.77 minor support intact. On the upside, above 109.89 will target 61.8% retracement of 114.54 to 104.69 at 110.77. We’d look for topping signal above there. On the downside, break of 107.77 will indicate completion of the rebound from 104.69. Intraday bias will be turned back to the downside for retesting this low.

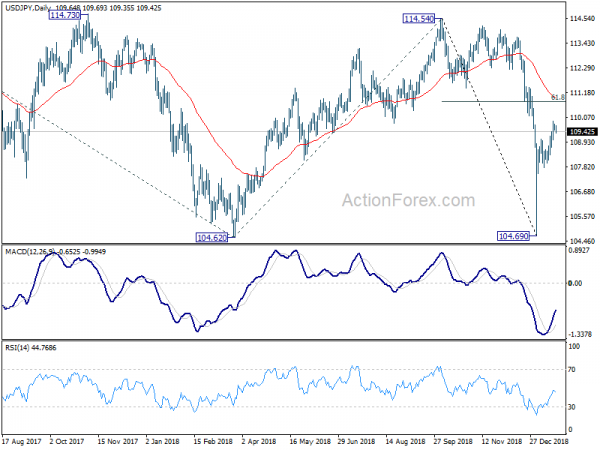

In the bigger picture, price actions from 125.85 (2015 high) are seen as a long term corrective pattern, no change in this view. Apparently, such corrective pattern is not completed yet. Fall from 114.54 is seen as part of the falling leg from 118.65 (2016 high). Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51, which is close to 100 psychological level. But in that case, we’d expect strong support from 98.97 to contain downside to bring reversal. Also, this bearish case will remain the preferred one as long as 114.54 resistance holds.