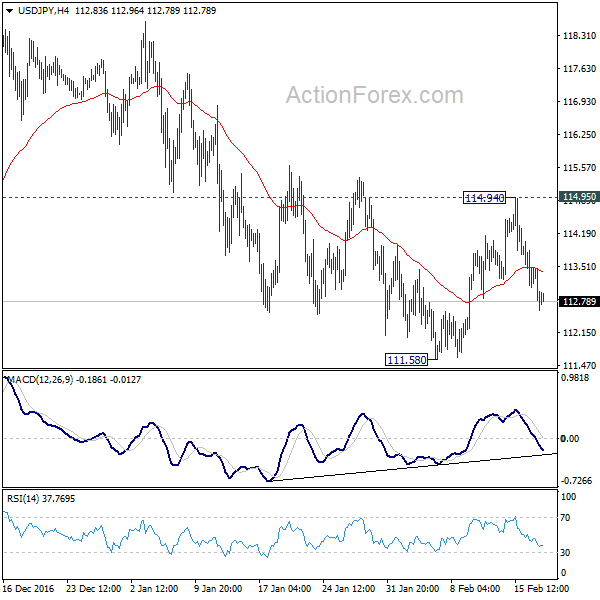

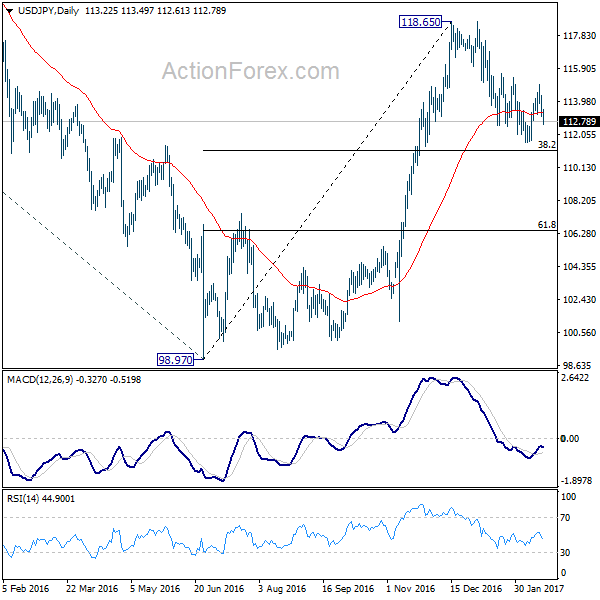

USD/JPY’s rebound from 111.58 was limited at 114.94 last week and reversed. The development suggests that corrective fall from 118.65 is not finished. Initial bias is mildly on the downside this week for 111.58 and below. Though, we’d still expect strong support from 38.2% retracement of 98.97 to 118.65 at 111.13 to contain downside and bring rebound. On the upside, above 114.94 resistance should confirm completion of pull back from 118.65. In such case, intraday bias will be turned back to the upside for retesting 118.65.

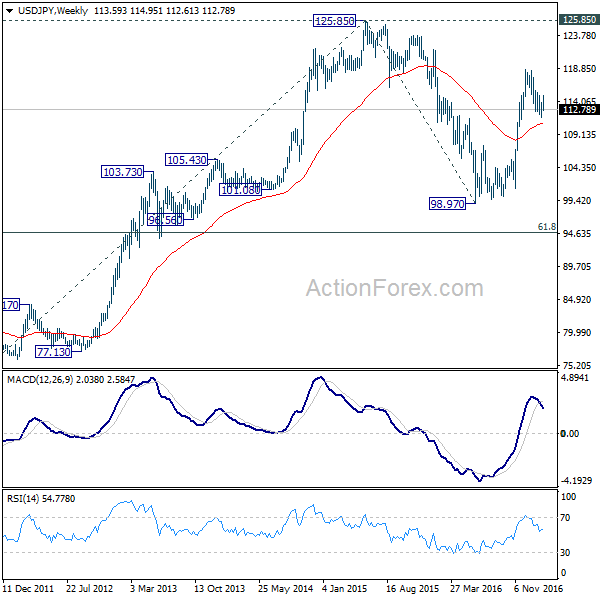

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.85 and below will extend the consolidation with another falling leg before up trend resumption.

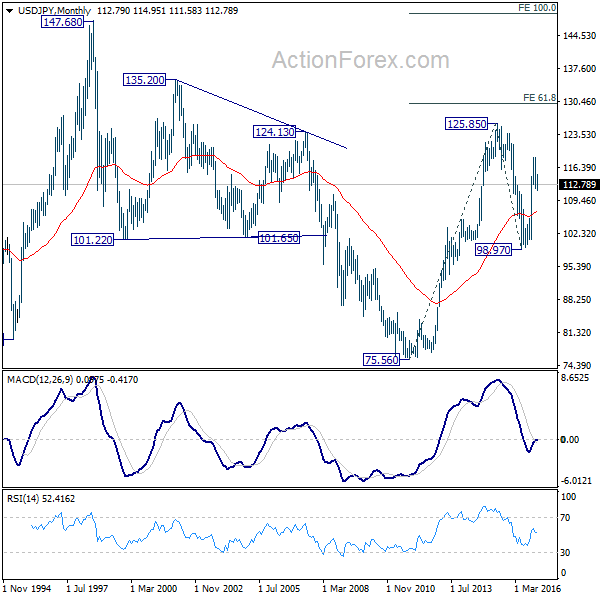

In the long term picture, the rise from 75.56 long term bottom to 125.85 medium term top is viewed as an impulsive move. Price actions from 125.85 are seen as a corrective move which could still extend. But, up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box