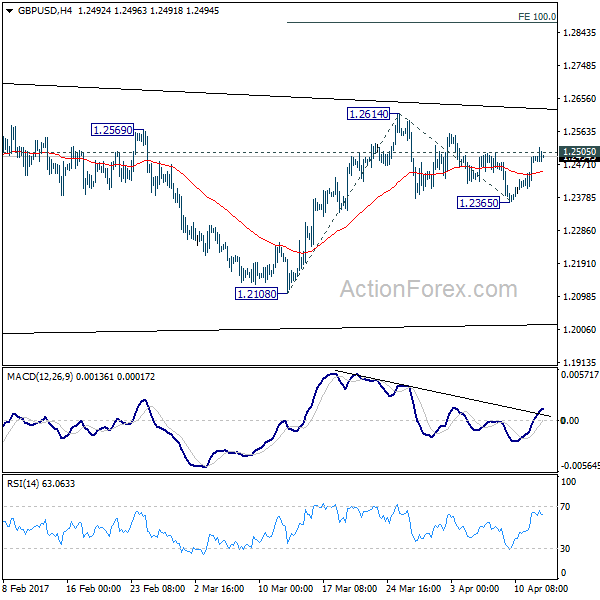

Daily Pivots: (S1) 1.2429; (P) 1.2462; (R1) 1.2523; More…

GBP/USD’s breach of 1.2505 resistance argues that pull back from 1.2614 has completed at 1.2365 already. Intraday bias is back on the upside for 1.2614 resistance first. Break there will resume whole rise from 1.2108 and target 100% projection of 1.2108 to 1.2614 from 1.2365 at 1.2871. But overall, price actions from 1.1946 low are viewed as a consolidation pattern. We’d expect strong resistance around 55 week EMA (now at 1.3015) to limit upside and bring down trend resumption. But for now, further rise will be favored in near term as long as 1.2365 support holds.

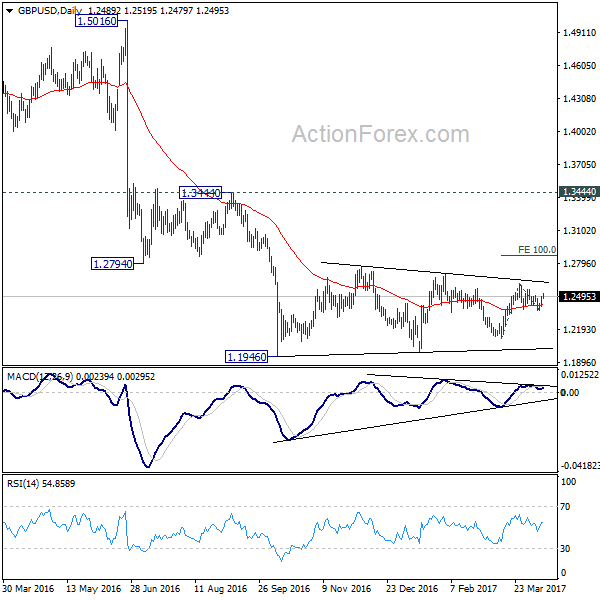

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term reversal yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.