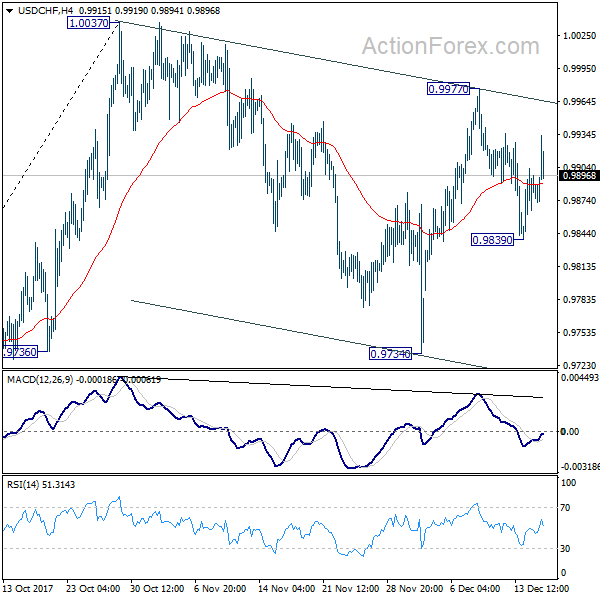

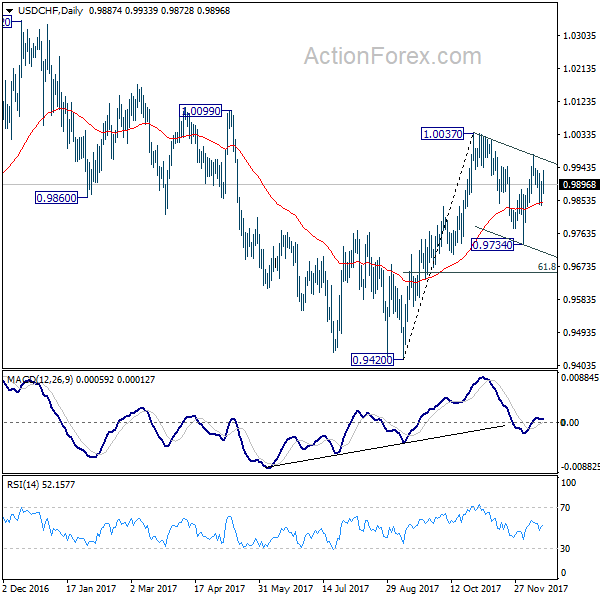

USD/CHF dropped to 0.9839 last week but drew support from 55 day EMA and recovered. Near term outlook is mixed up a bit and initial bias is neutral this week first. on the upside, above 0.9977 will resume the rebound fro m0.9734 for 1.0037 resistance. Break there will resume whole rally from 0.9420 and target 1..0342 key resistance next. on the downside, below 0.9839 will likely extend the correction from 1.0037 through 0.9734. But in that case, we’d expect strong support from 61.8% retracement of 0.9420 to 0.1.0037 at 0.9656 to contain downside and bring rebound.

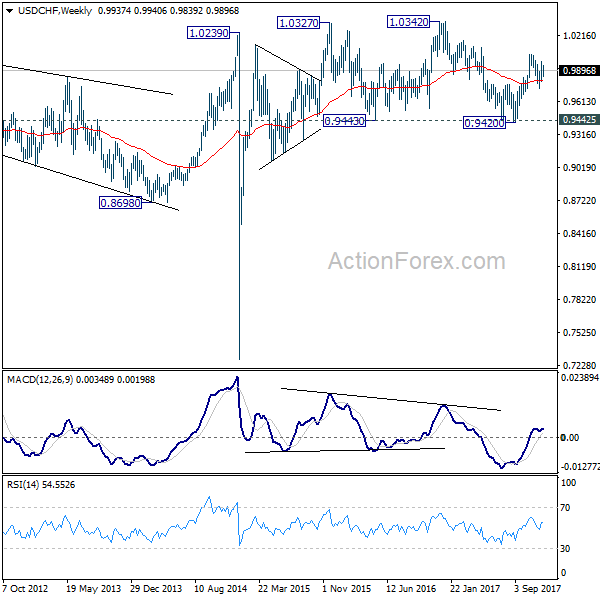

In the bigger picture, range trading continues between 0.9420/1.0342. At this point, 0.9420 appears to be a strong support level. Therefore, in case of decline attempt, we don’t expect a firm break of this level. Nonetheless, strong break of 1.0342 is also needed to confirm upside momentum. Otherwise, medium term outlook will stay neutral.

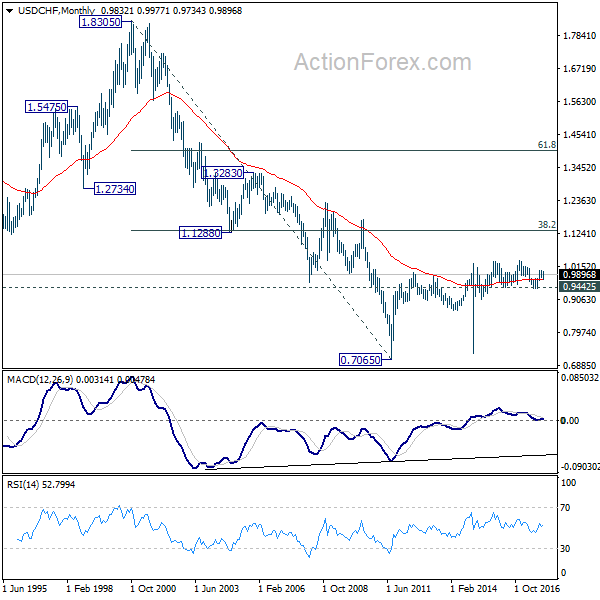

In the long term picture, while upside momentum is unconvincing, with 0.9443 key support intact, rise from 0.7065 (2011 low) is still expected to continue. Break of 1.0342 will target 38.2% retracement of 1.8305 (2000 high) to 0.7065 at 1.1359.