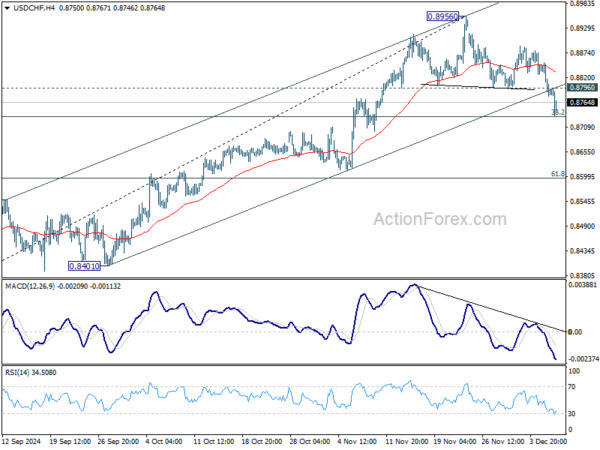

Daily Pivots: (S1) 0.8758; (P) 0.8806; (R1) 0.8832; More…

USD/CHF’s fall from 0.8956 short term top extends lower in early US session and touched 55 D EMA (now at 0.8737. Strong support could be seen from current level, and firm break of 0.8796 resistance will turn bias back to the upside for rebound. However, considering head and shoulder top pattern, firm break of the EMA will argue that whole rise from 0.8401 might have completed, and bring deeper decline to 61.8% retracement of 0.8401 to 0.8956 at 0.8613 next.

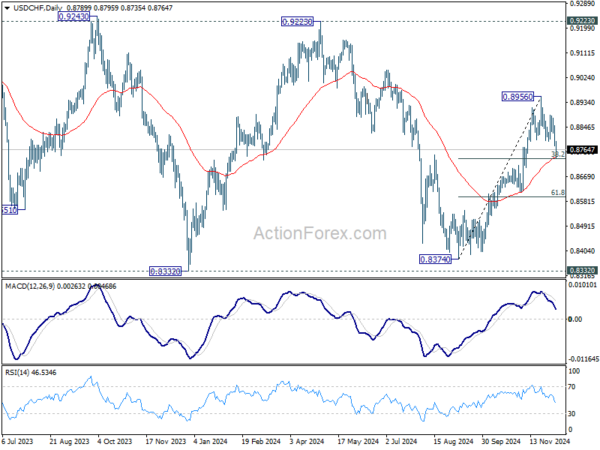

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern. Rise from 0.8374 is seen as the third leg. Overall outlook will continue to stay bearish as long as 0.9223 resistance holds. Break of 0.8332 low is in favor at a later stage when the consolidation completes.