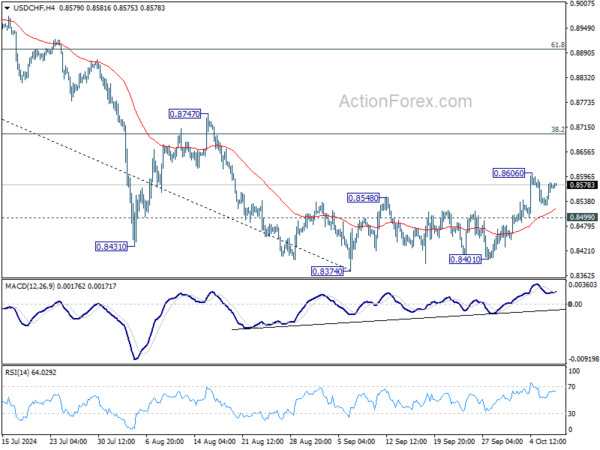

Daily Pivots: (S1) 0.8541; (P) 0.8562; (R1) 0.8595; More…

Intraday bias in USD/CHF remains neutral for consolidations below 0.8606 temporary top. Further rise is in favor as long as 0.8499 minor support holds. Above 0.8606 will target 38.2% retracement of 0.9223 to 0.8374 at 0.8698. Sustained break there will argue that fall from 0.9223 has completed after defending 0.8332 low. Next target will be 61.8% retracement at 0.8899. On the downside, break of 0.8499 will turn bias back to the downside for retesting 0.8374 low instead.

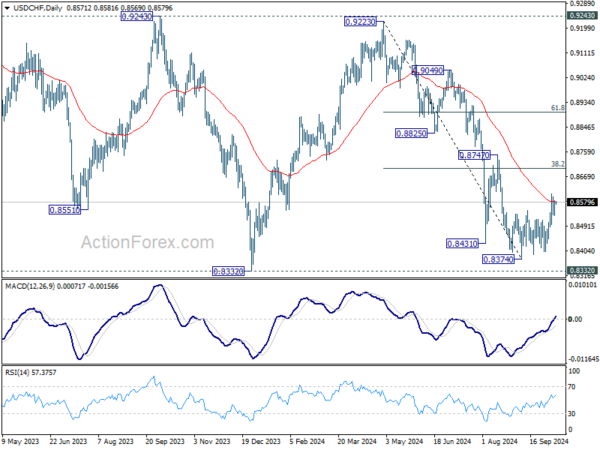

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).