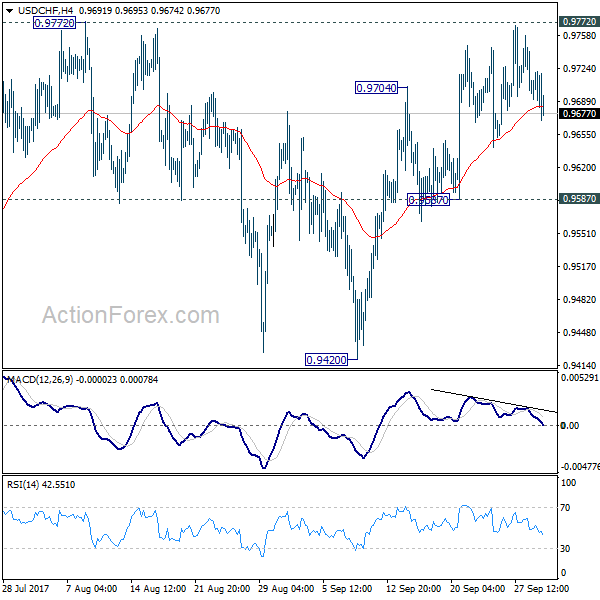

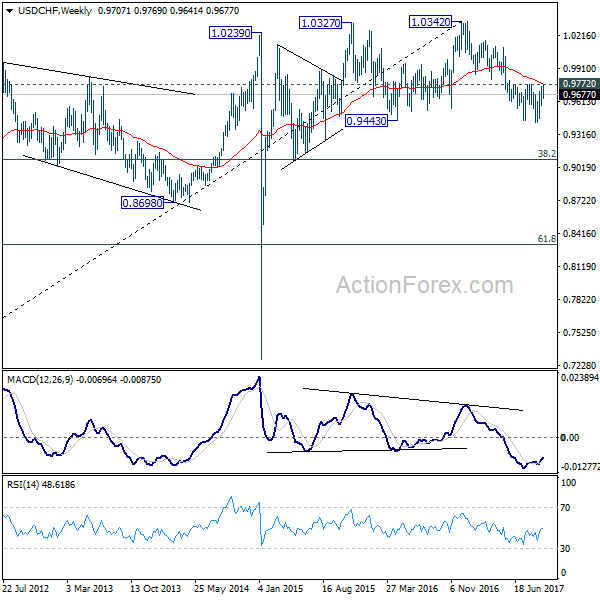

USD/CHF edged higher to 0.9769 last week but failed to take out 0.9772 key near term resistance. Also, upside was limited below 55 week EMA (now at 0.9777). Initial bias remains neutral this week first. On the upside, decisive break of 0.9772 will suggest that whole down trend form 1.0342 has completed after defending 0.9443 key support again. That would also complete a double bottom pattern (0.9437, 9420). In that case, near term outlook will be turned bullish for 0.9860/1.0099 resistance zone first. Nonetheless, with 0.9772 resistance intact, outlook remains bearish. Below 0.9587 minor support will turn bias back to the downside for retesting 0.9420 low.

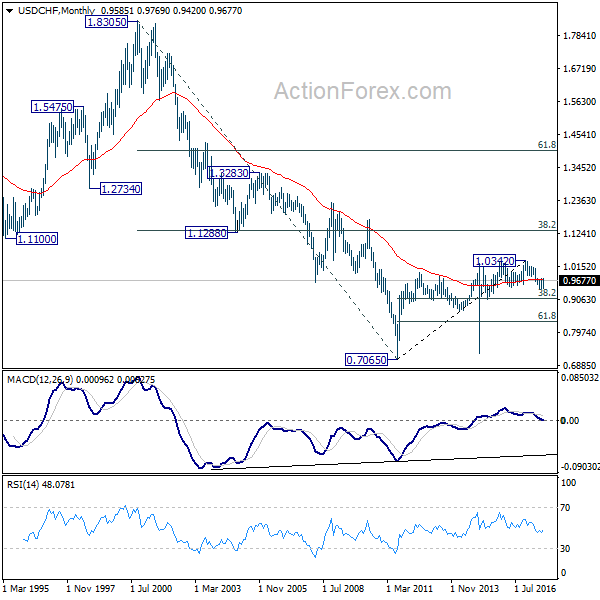

In the bigger picture, focus remains on whether 0.9443 key support (2016 low) would be taken out firmly as down trend from 1.0342 extends. There are various interpretation of the price actions. But in any case, medium term outlook will stay bearish as long as 0.9772 resistance holds. Current down trend could extend to 38.2% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.9090. However, break of 0.9772 will indicate that USD/CHF has successfully defended 0.9443 again and turn outlook bullish for 1.0099 resistance.