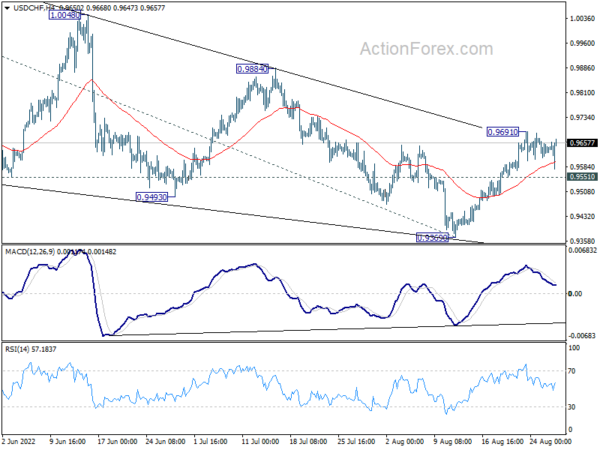

USD/CHF rose further to 0.9691 last week but retreated since then. Initial bias is neutral this week first. Triangle correction from 1.0063 could have completed at 0.9369 already. Above 0.9691 will resume the rise from 0.9369 and target 0.9884 resistance next. Break there will argue that larger up trend is ready for resumption through 1.0063. On the downside, below 0.9551 minor support will dampen this view and turn bias back to the downside for 0.9369 support instead.

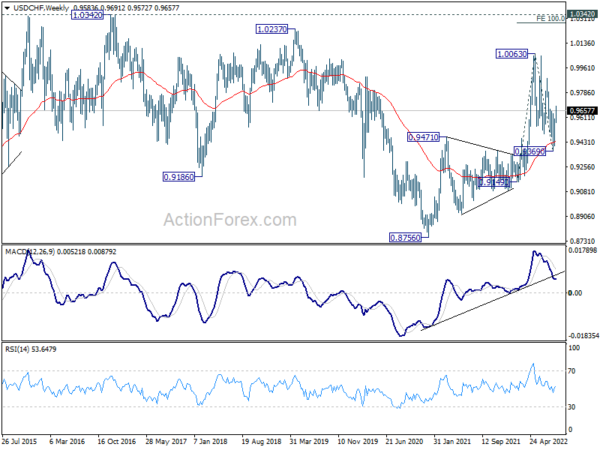

In the bigger picture, current development suggests that up trend from 0.8756 (2021 low) is still in progress. Sustained break of 1.0063 will target 100% projection of 0.9149 to 1.0063 from 0.9369 at 1.0283, and then 1.0342 (2016 high). For now, this will remain the favored case as long as 0.9369 support holds, even in case of deep pull back.

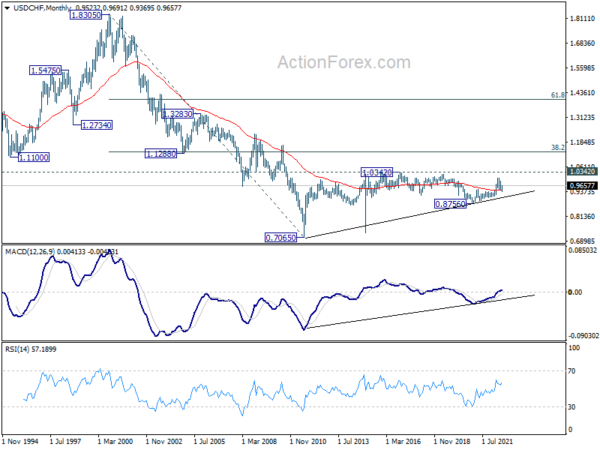

In the long term picture, outlook is mixed with deeper than expected fall from 1.0063, but some support is seen from 55 week EMA (now at 0.9433). Overall, though, USD/CHF is seen as in sideway pattern from 1.0342 (2016 high). Range trading should continue until further development.