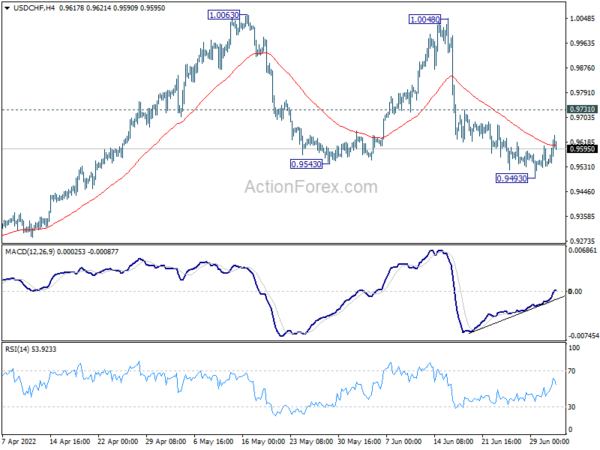

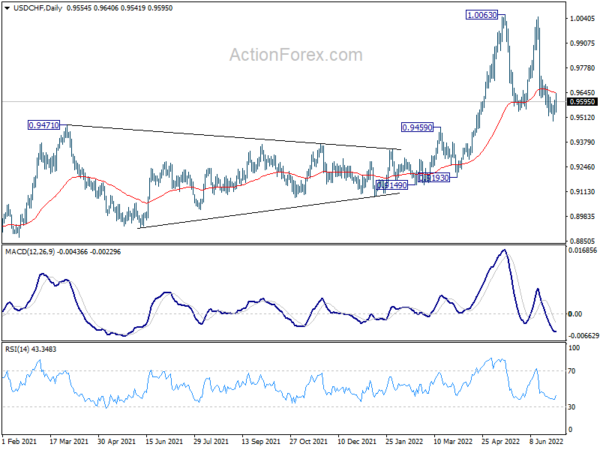

USD/CHF edged lower to 0.9493 last week but quickly recovered. Initial bias stays neutral this week and outlook is unchanged. Price actions from 1.0063 are still seen as a consolidation pattern. On the upside, break of 0.9731 resistance will argue that such consolidation has completed and bring stronger rally back to retest 1.0063 high. However, another fall below 0.9493 will dampen this view and target 0.9459 resistance turned support.

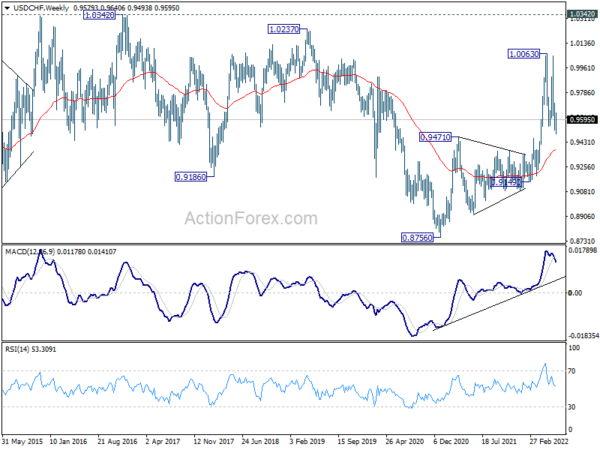

In the bigger picture, down trend from 1.0342 (2016 high) should have completed with three waves down to 0.8756 (2021 low) already. Rise from 0.8756 is likely a medium term up trend of its own. Next target is 1.0237/0342 resistance zone. This will remain the favored case as long as 0.9471 resistance turned support holds. However, sustained break of 0.9471 will extend long term range trading with another falling leg.

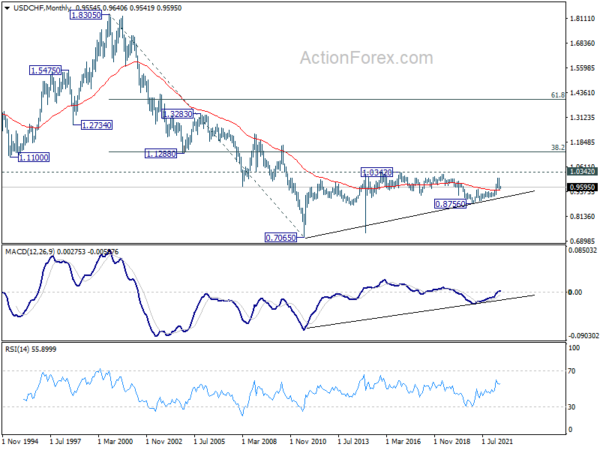

In the long term picture, current development argues that the correction from 1.0342 (2016 high) has completed at 0.8756 (2020 low) already. Rise from 0.7065 (2011 low) might be ready to resume. Firm break of 1.0342 will confirm and target 38.2% retracement of 1.8305 (2000 high) to 0.7065 at 1.1359.