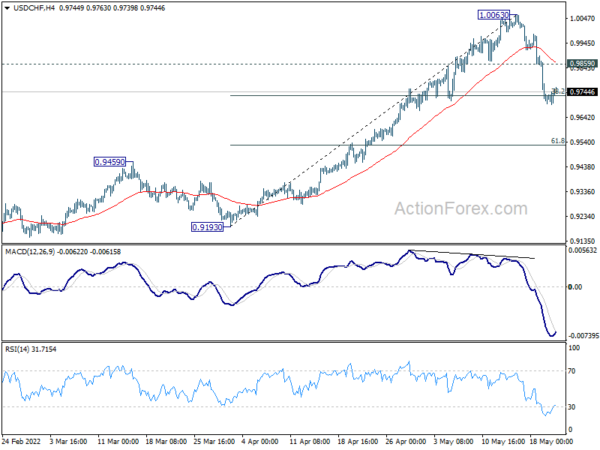

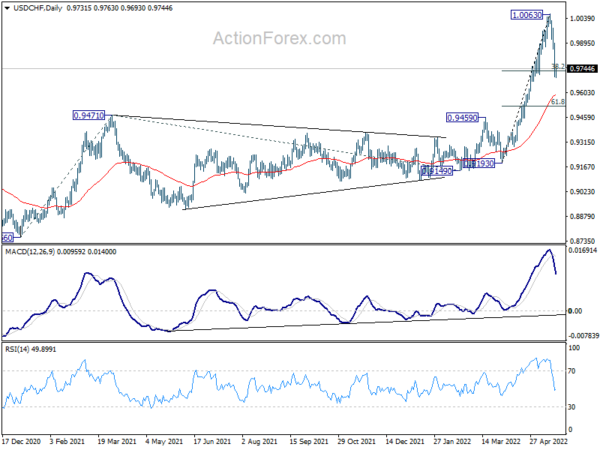

USD/CHF edged higher to 1.0063 last week but reversed sharply from there. A short term top should be in place. Initial bias remains mildly on the downside for deeper correction. Sustained break of 38.2% retracement of 0.9193 to 1.0063 at 0.9731 will target 55 day EMA (now at 0.9589). But downside should be contained by 61.8% retracement at 0.9525 to bring rebound. On the upside, above 0.9859 minor resistance will bring retest of 1.0063 high.

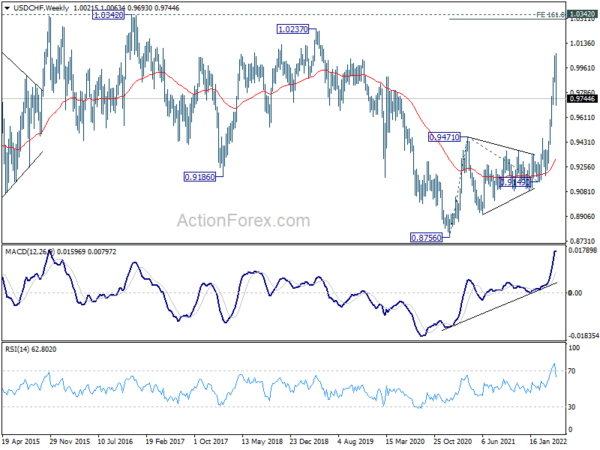

In the bigger picture, down trend from 1.0342 (2016 high) should have completed with three waves down to 0.8756 (2021 low) already. Rise from 0.8756 is likely a medium term up trend of its own. Next target is 161.8% projection of 0.8756 to 0.9471 from 0.9149 at 1.0306, which is close to 1.0342 (2016 high). This will remain the favored case as long as 0.9459 resistance turned support holds.

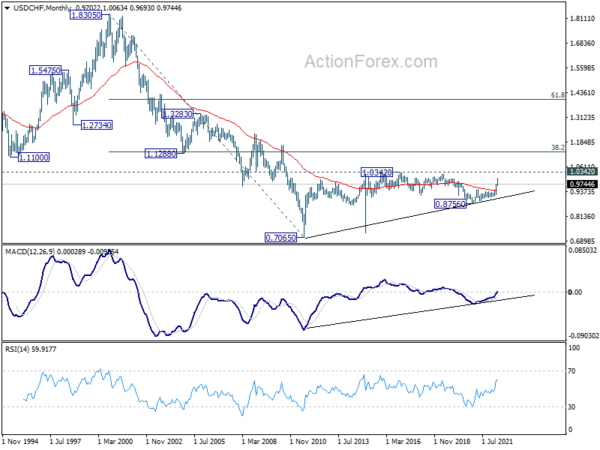

In the long term picture, current development argues that the correction from 1.0342 (2016 high) has completed at 0.8756 (2020 low) already. Rise form 0.7065 (2011 low) might be ready to resume. Firm break of 1.0342 will confirm and target 38.2% retracement of 1.8305 (2000 high) to 0.7065 at 1.1359.