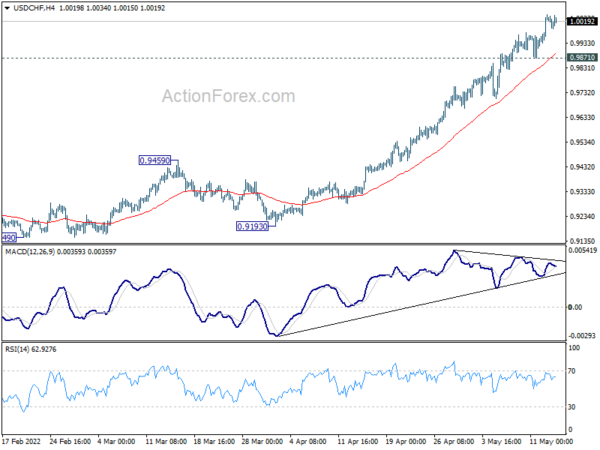

USD/CHF’s up trend continued last week and there is no clear sign of topping. Initial bias stays on the upside this week. Next target is 1.0306 medium term fibonacci projection level. On the downside, considering bearish divergence condition in 4 hour MACD, break of 0.9871 support will indicate short term topping, and turn bias to the downside for pull back.

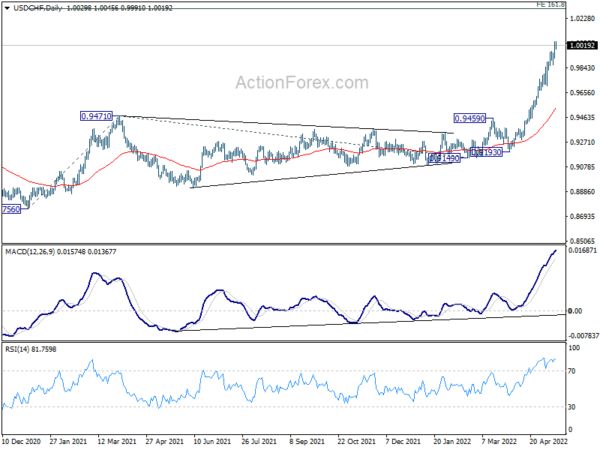

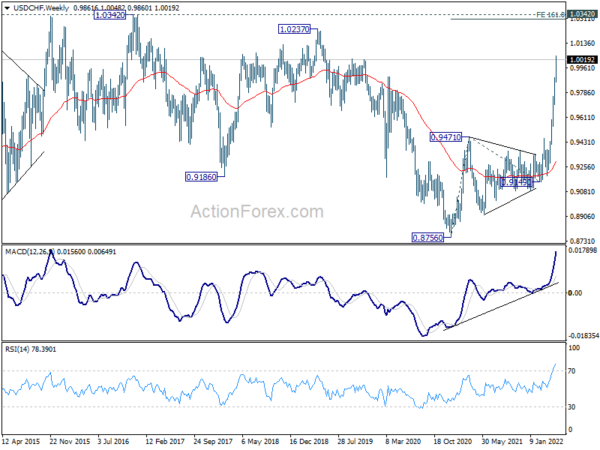

In the bigger picture, down trend from 1.0342 (2016 high) should have completed with three waves down to 0.8756 (2021 low) already. Rise from 0.8756 is likely a medium term up trend of its own. Next target is 161.8% projection of 0.8756 to 0.9471 from 0.9149 at 1.0306, which is close to 1.0342 (2016 high). This will remain the favored case as long as 0.9459 resistance turned support holds.

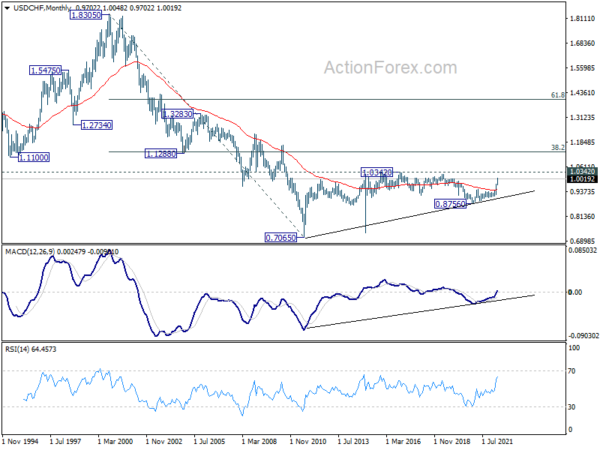

In the long term picture, current development argues that the correction from 1.0342 (2016 high) has completed at 0.8756 (2020 low) already. Rise form 0.7065 (2011 low) might be ready to resume. Firm break of 1.0342 will confirm and target 38.2% retracement of 1.8305 (2000 high) to 0.7065 at 1.1359.