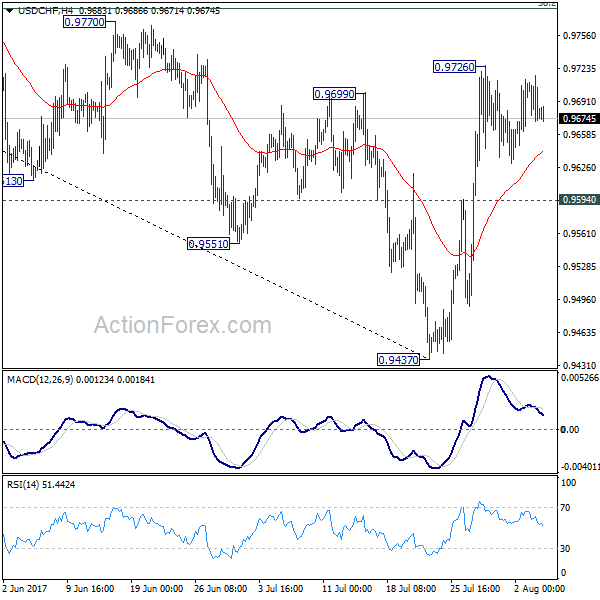

Daily Pivots: (S1) 0.9665; (P) 0.9690; (R1) 0.9710; More…

Intraday bias in USD/CHF remains neutral as consolidation from 0.9726 temporary top continues. . Another rise is expected as long as 0.9594 support holds. Prior break of 0.9699 resistance suggests near term reversal after defending 0.9443 key support. Above 0.9726 will target 38.2% retracement of 1.0342 to 0.9437 at 0.9783 first. Break will target channel resistance (now at 0.9890). However, firm break of 0.9594 will dampen this bullish view and turn bias back to the downside for 0.9437.

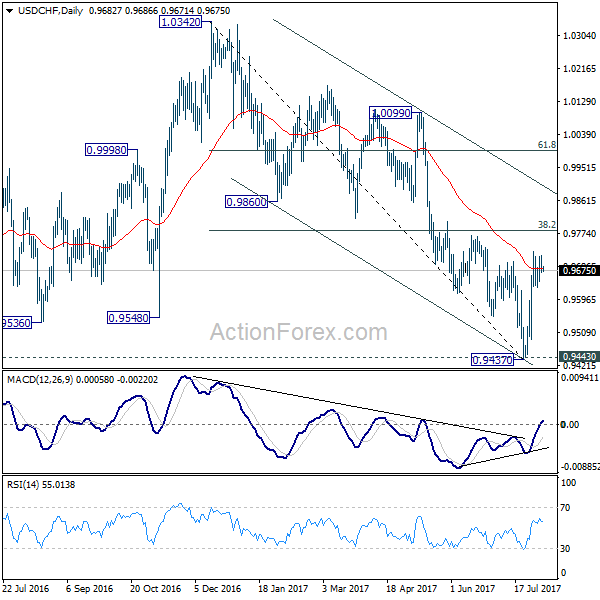

In the bigger picture, current development argues that USD/CHF has successfully defended 0.9443 key support level. And long term range trading in 0.9443/1.0342 is extending with another rise. At this point, there is no sign of an up trend yet. Hence, while further rise is expected in USD/CHF, we’ll start to be cautious on loss of momentum above 61.8% retracement of 1.0342 to 0.9437 at 0.9996.