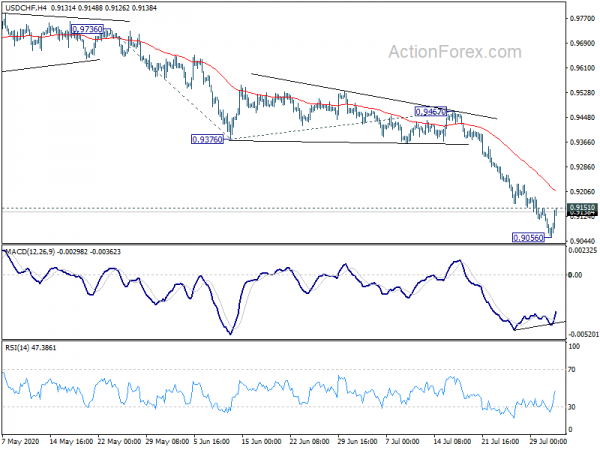

USD/CHF’s down trend accelerated to as low as 0.9056 last week. As a temporary low was formed, initial bias is neutral this week first. Considering mild bullish convergence condition in 4 hour MACD, Break of 0.9151 minor resistance will suggest short term bottoming. Intraday bias will be turned back to the upside for rebound to 4 hour 55 EMA (now at 0.9208) and above. But upside should be limited below 0.9376 support turned resistance. On the downside, break of 0.9056 will extend the down trend to 161.8% projection of 0.9736 to 0.9376 from 0.9467 at 0.8885.

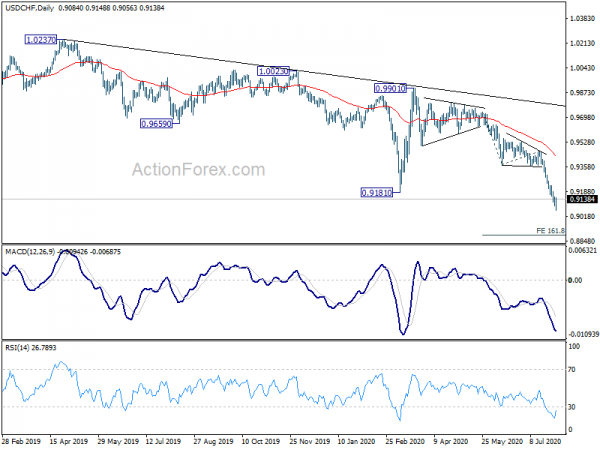

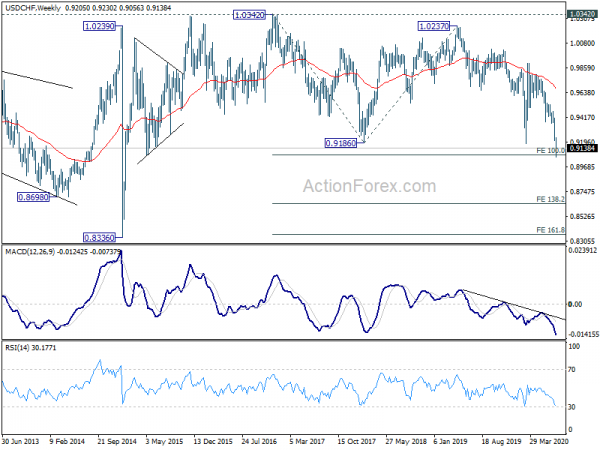

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). Current development suggests that such pattern is still extending. Sustain trading below 100% projection of 1.0342 to 0.9186 from 1.0237 at 0.9081 will pave the way to 138.2% projection at 0.8639. On the upside, break of 0.9376 resistance is needed to be the first sign of medium term bottoming.

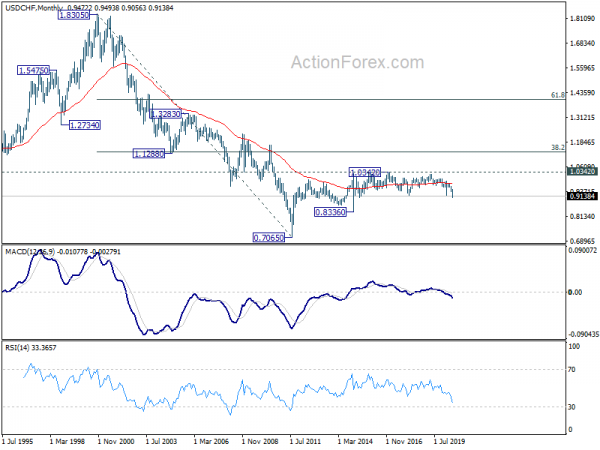

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.