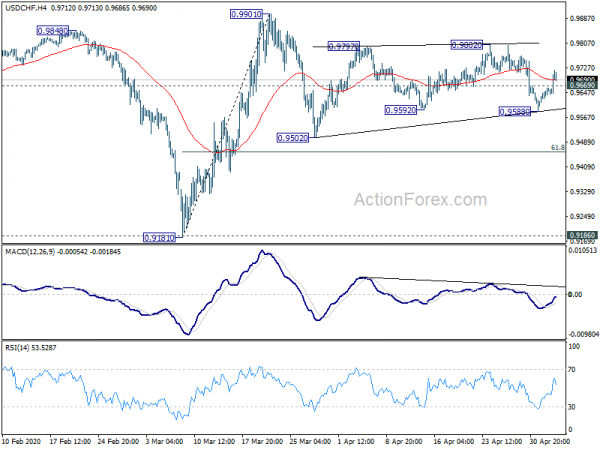

Daily Pivots: (S1) 0.9625; (P) 0.9644; (R1) 0.9676; More…

USD/CHF’s break of 0.9669 minor resistance suggests completion of fall from 0.9802. Intraday bias is turned back to the upside for 0.9802 first. Break will target a test on 0.9901 resistance. On the downside, below 0.9588 will turn bias to the downside for 0.9502 support. Overall, price actions from 0.9901 are in progress and downside should be contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound.

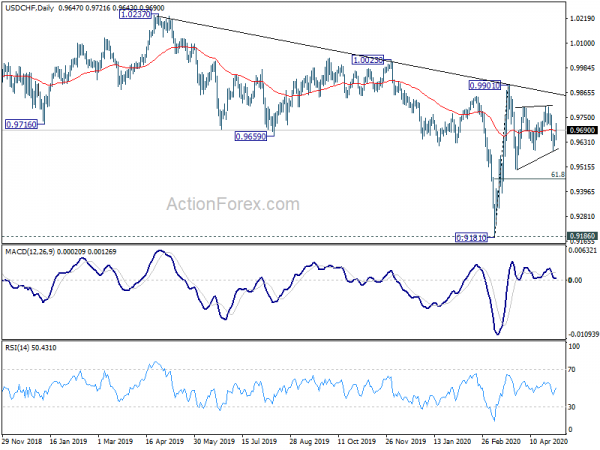

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.