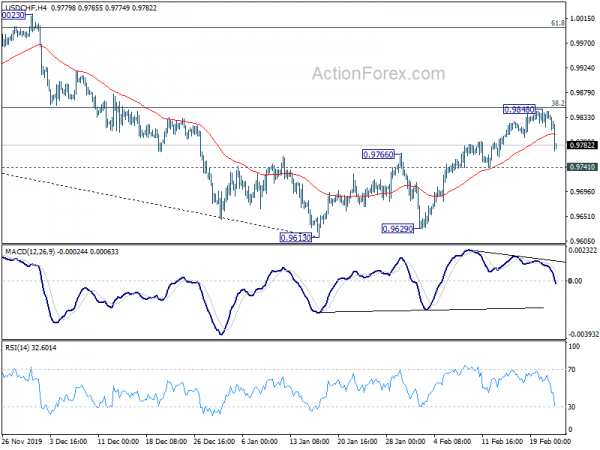

USD/CHF rebounded further to 0.9848 last week but failed to break 38.2% retracement of 1.0237 to 0.9613 at 0.9851 and retreated sharply. Initial bias is neutral this week. On the downside, break of 0.9741 will suggest rejection by 0.9851 and retain near term bearishness. Intraday bias will be turned back to the downside for retesting 0.9613 low. On the upside, sustained break of 0.9851 will add to the case of bullish near term reversal and target 61.8% retracement at 0.9999 next.

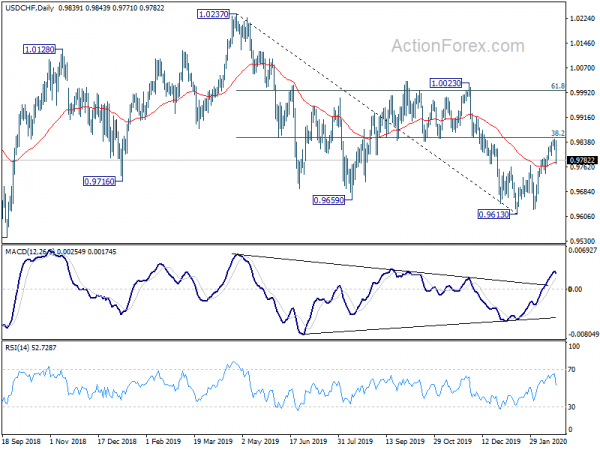

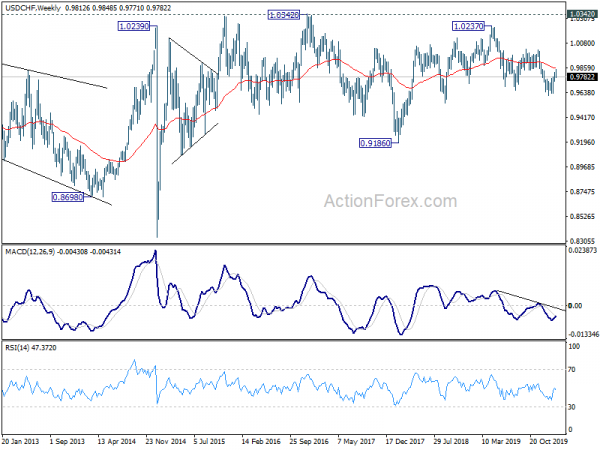

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.

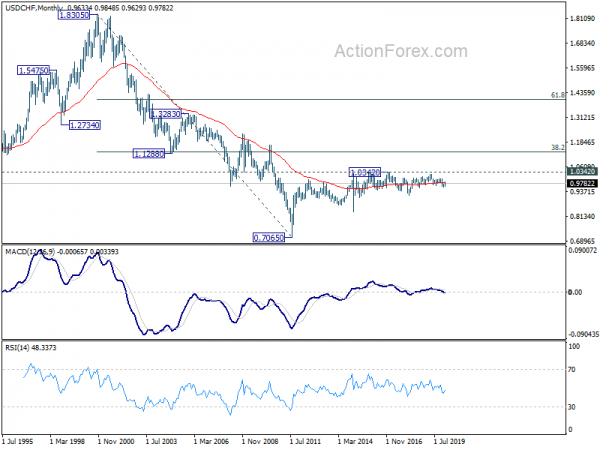

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.