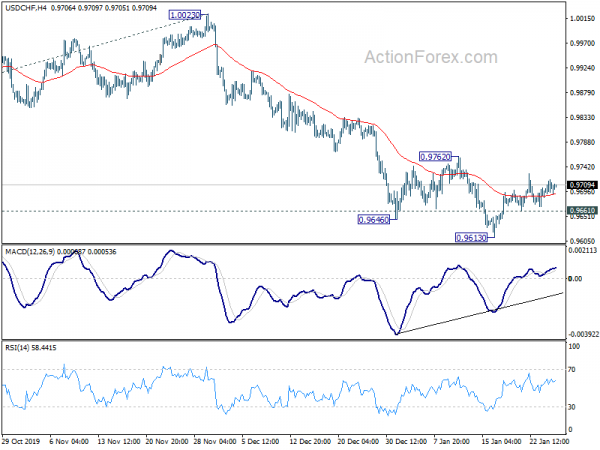

Daily Pivots: (S1) 0.9695; (P) 0.9707; (R1) 0.9724; More…

Intraday bias in USD/CHF remains neutral as consolidation from 0.9613 is still in progress. Upside should be limited by 0.9762 resistance to bring down trend resumption. Below 0.9661 minor support will bring retest of 0.9613 low first. Break will target 100% projection of 1.0237 to 0.9659 from 1.0023 at 0.9445. However, considering bullish convergence condition in 4 hour MACD, break of 0.9762 will indicate near term reversal and turn outlook bullish for stronger rebound to 55 day EMA (now at 0.9787).

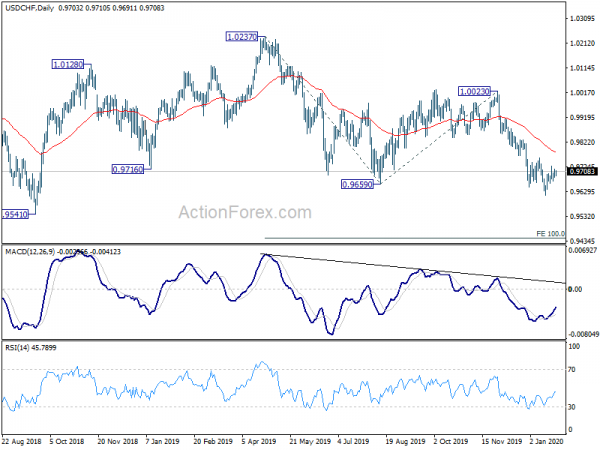

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.