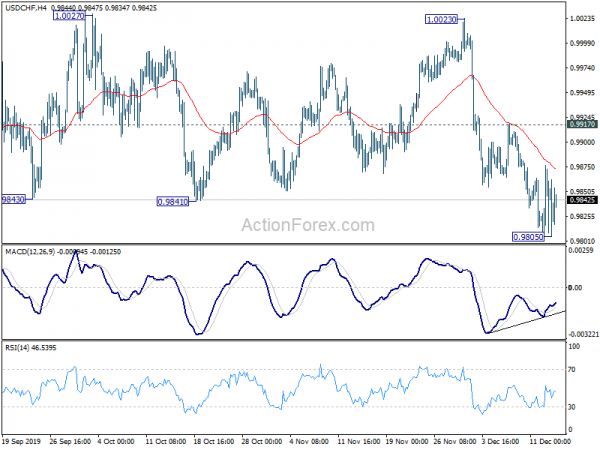

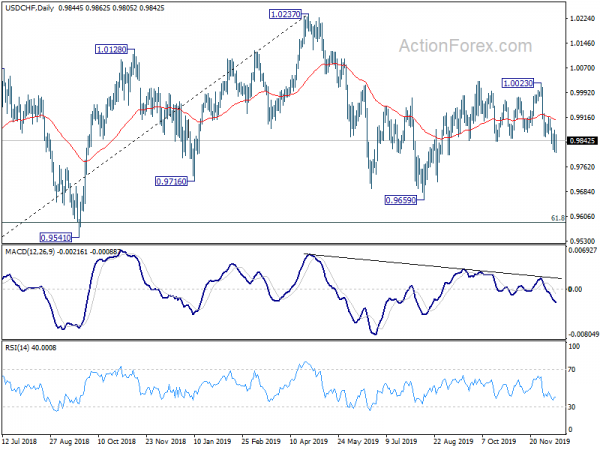

USD/CHF dropped further to as low as 0.9805 last week but recovered since then. Initial bias remains neutral this week first. The break of 0.9841 support argues that rebound from 0.9659 has completed already. Further decline will remain in favor as long as 0.9917 resistance holds. On the downside, below 0.9805 will resume the fall from 1.0023 and target 0.9659 support next. On the upside, break of 0.9917 will dampen this bearish view and turn bias back to the upside for 1.0023 resistance instead.

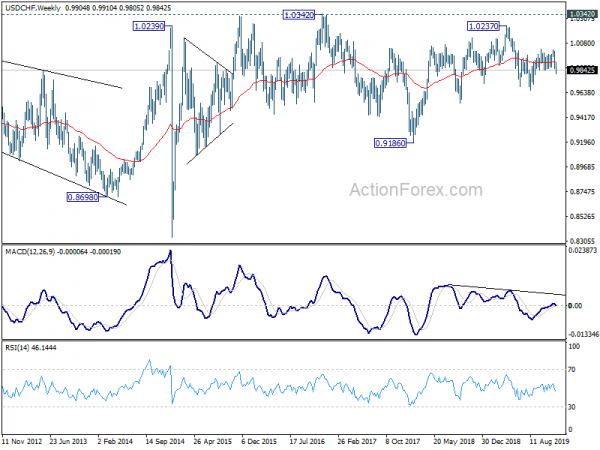

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying in range of 0.9659/1.0237. In any case, decisive break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall. Meanwhile, break of 0.9695 support will target 0.9541 support instead.

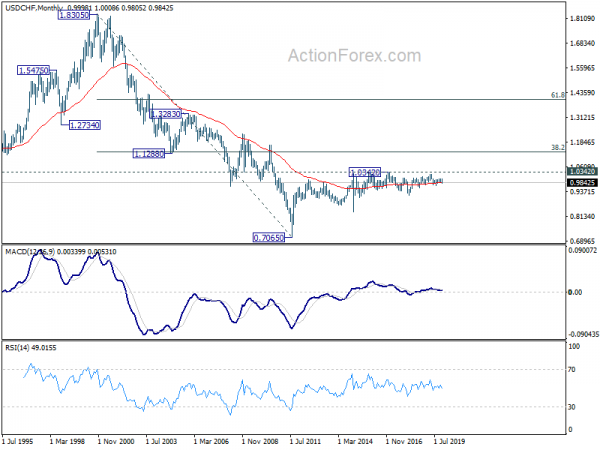

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.