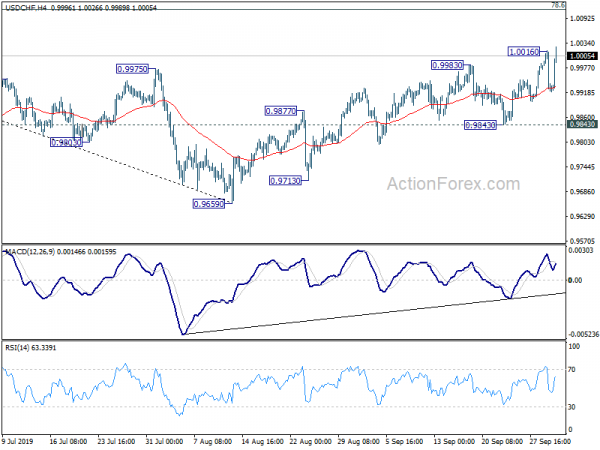

Daily Pivots: (S1) 0.9896; (P) 0.9957; (R1) 0.9990; More…

USD/CHF drew strong support from 4 hour 55 EMA and rebounded. Break of 1.0016 suggests resumption of whole rise from 0.9659 low. Intraday bias is back on the upside for 78.6% retracement of 1.0237 to 0.9659 at 1.0113 next. On the downside, break of 0.9843 support is needed to indicate short term reversal. Otherwise, near term outlook will remain cautiously bullish in case of retreat.

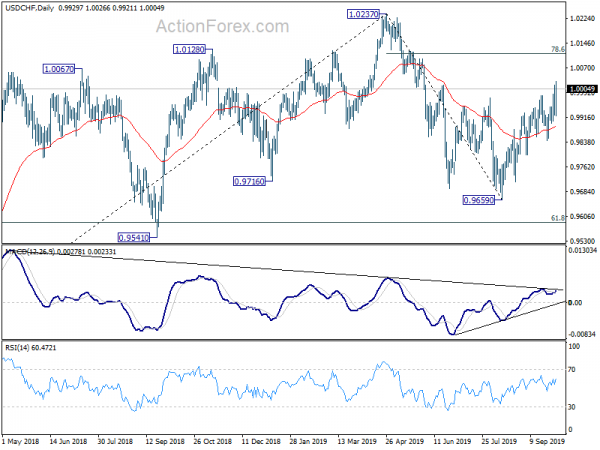

In the bigger picture, the structure of the fall from 1.0237 suggests that it’s a corrective move. Sustained break of 0.9975 will argue that such correction has completed at 0.9659, ahead of 61.8% retracement of 0.9186 to 1.0237 at 0.9587. But decisive break of 1.0237 is needed to indicate up trend resumption. Otherwise, medium term outlook will stay neutral first. Meanwhile, break of 0.9695 support will extend the correction to 0.9541 support instead.