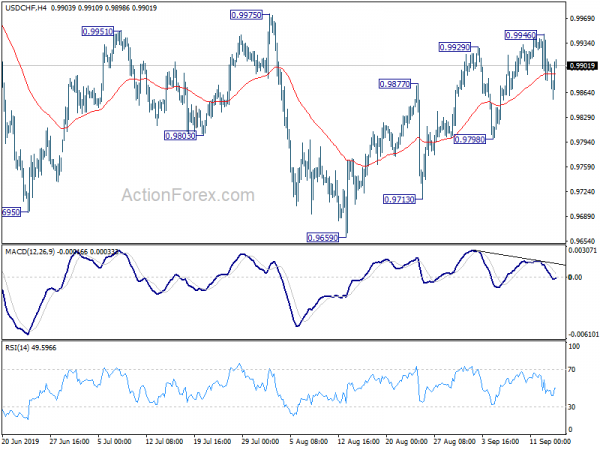

USD/CHF’s rebound from 0.9659 extended higher last even though it continued to lose upside momentum, as seen bearish divergence condition in 4 hour MACD. Initial bias is neutral this week first. Further rise is in favor as long as 0.9798 support holds. Break of 0.9946 will target 0.9975 resistance first. But break o f0.9798 will turn bias to the downside for retesting 0.9659/9713 support zone instead.

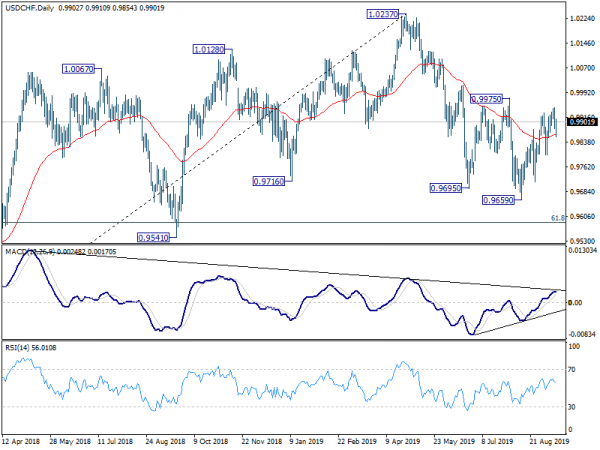

In the bigger picture, the structure of the fall from 1.0237 suggests that it’s a corrective move. Break of 0.9975 will argue that such correction has completed at 0.9659, ahead of 61.8% retracement of 0.9186 to 1.0237 at 0.9587. But decisive break of 1.0237 is needed to indicate up trend resumption. Otherwise, medium term outlook will stay neutral first. Meanwhile, break of 0.9695 support will extend the correction to 0.9541 support instead.

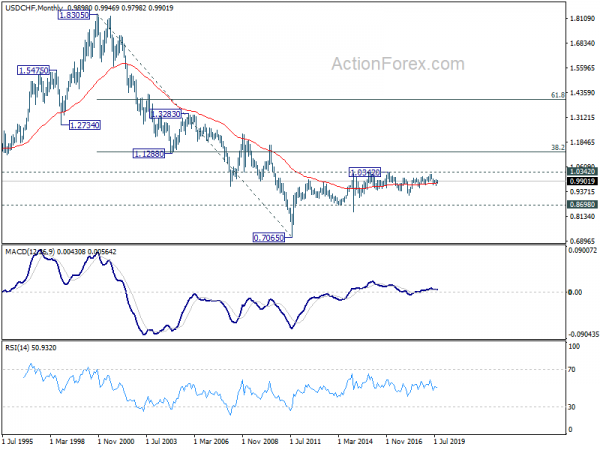

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.