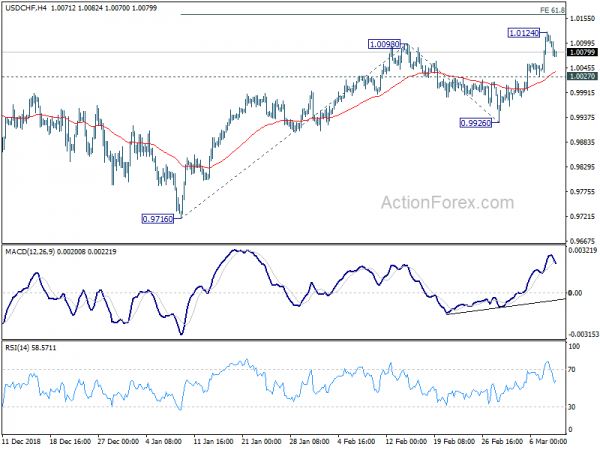

USD/CHF rose further to 1.0124 last week but formed a temporary top there and retreated. Initial bias is neutral this week for some consolidations first. The break of 1.0098 indicates resumption of rise from 0.9716. Hence, retreat from 1.0124 should be contained by 1.0027 minor support to bring another rally. On the upside, break of 1.0124 will target 61.8% projection of 0.9716 to 1.0098 from 0.9926 at 1.0162 and then 100% projection at 1.0308.

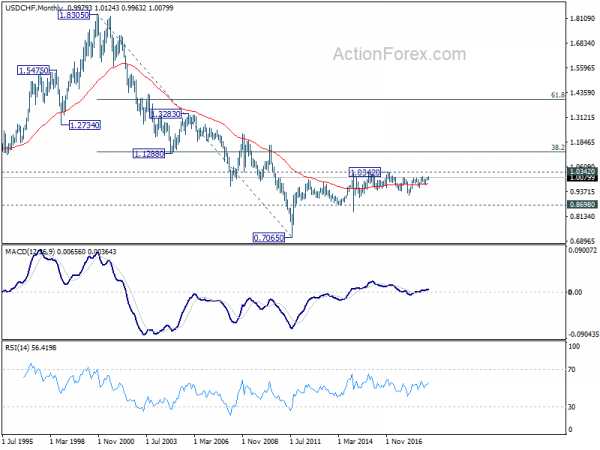

In the bigger picture, USD/CHF drew strong support from medium term trend line and rebounded. That suggests rise from 0.9186 is still in progress. Further break of 1.0128 will confirm up trend resumption and target 1.0342 key resistance. Nevertheless, break of 0.9926 support will be the first signal of medium term reversal and bring another test on the trend line.

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.